What Is the Distinction Between a Bull and Bear Market?

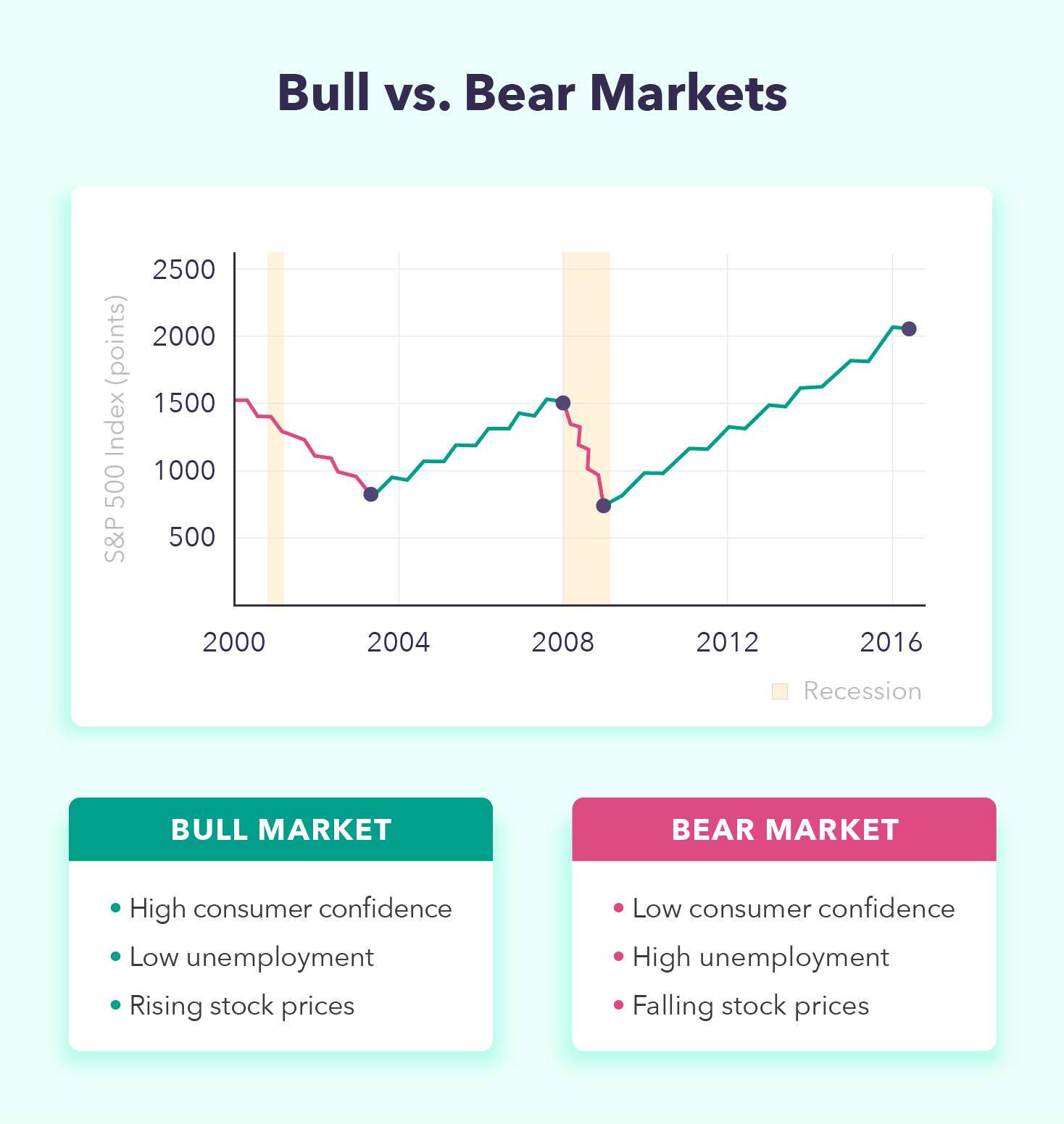

A bull market is a time of financial success, low unemployment, and shopper confidence. Conversely, a bear market is a time of financial downturn, excessive unemployment, and diminished shopper spending.

In case you overhear a dialog about bears and bulls, it won’t be about somebody’s latest journey to the zoo. Actually, they could be speaking about bull and bear markets. In any case, 55 % of People put money into the inventory market. However even when you’ve invested earlier than, chances are you’ll be asking your self, “What’s the distinction between a bull and bear market?”

For an in-depth understanding of the variations between a bull vs. bear market and the way these developments have an effect on funding actions, proceed studying this information.

What Is a Bull Market?

A bull market is a time of financial progress and shopper confidence. Throughout this time, the financial system is prospering, and there are low unemployment charges. In a bullish market, you possibly can count on inventory costs to extend over 20 % for an prolonged interval. Due to this, traders are seemingly to purchase and maintain onto their shares.

What Is a Bear Market?

A bear market is the alternative of a bullish market, representing an financial downturn and excessive unemployment charges. When a bear market happens, inventory costs will fall over 20 % for a protracted time period. These plummeting inventory costs will lead many traders to promote their securities for the security of money.

Variations Between a Bull and Bear Market

As you possibly can most likely guess, there are some vital variations when evaluating bear vs. bull markets. Nonetheless, to higher perceive the financial circumstances that result in every one — and what to look out for to guard your capital — it’s vital to focus on a number of key variations.

Investor Attitudes

In relation to bull and bear buying and selling, investor attitudes have a tendency to vary relying on the present market. In a bullish market, traders are normally optimistic and wanting to capitalize on the earnings. To take action, traders will purchase and maintain onto their securities of selection, hoping to earn cash as the costs pattern upward.

In a bearish market, it’s fairly the alternative. As a substitute, traders are uncertain and never prepared to danger dropping their investments. To keep away from dropping cash, traders will promote no matter they’ll and go away the market in favor of money.

Provide and Demand

Provide and demand are the bread and butter of economics, so it’s good to know the way they’re affected by bear and bull markets. For instance, a bull market has a substantial demand for equities and securities. Due to this, there finally ends up being a decrease provide of shares, additional growing the value.

Throughout a bear market, you possibly can count on to see the alternative. With many traders promoting their shares, the provision will increase whereas the demand diminishes, sinking the inventory worth and main traders to worry dropping their investments.

Financial Exercise

The ultimate distinction to notice when evaluating a bullish vs. bearish market is that bull markets are normally related to robust economies and bear markets with economies in bother. For instance, in a bear market, many companies could also be unable to report a excessive web revenue because of shoppers being much less prepared to spend.

On the flip aspect, most individuals will seemingly have extra disposable revenue for guilt-free spending in a bull market, growing their willingness to spend it. This conduct may also help companies thrive and subsequently strengthen the financial system.

What Buyers Ought to Do in a Bull vs. Bear Market

Now that you recognize the variations between a bear vs. bull market, right here’s the massive query: What must you do in every market? Comply with alongside, and let’s check out every.

What To Do in a Bull Market

In a bull inventory market, chances are you’ll hear folks saying that it’s essential benefit from the rising costs. One methodology many traders use is the buy-and-hold technique. When training this funding technique, you’ll purchase shares with the intention of holding them whereas the costs enhance.

Nonetheless, that is simpler mentioned than finished. It’s good to do not forget that all investing comes with some danger. Due to this, many traders might select to develop their cash slowly utilizing low-risk investments.

What To Do in a Bear Market

Bear inventory markets are trickier, because it’s exhausting to say which corporations might survive and bounce again with new earnings and which of them go underneath — and take your capital with them. Nonetheless, when you’re investing within the brief time period, it’s a good suggestion to analysis which corporations are more likely to survive and solely take into account investing in these.

And keep in mind, there’s at all times a superb diploma of danger when investing in a unstable market. In case you’re in it for the lengthy haul (like an index fund or retirement account), it’s finest to keep away from panic promoting. Chances are high, because the historical past of the inventory market has proved, the financial system will get better and your holdings will start to understand once more.

The Backside Line

Earlier than you begin investing, right here’s what to recollect about bull markets vs. bear markets:

- A bull market is when shares go up in worth, in flip enhancing the financial system and employment charges. They normally final a few years.

- A bear market is when shares are dropping worth, the financial system appears to be like unsure, and unemployment would possibly enhance. Bear markets are inclined to final only a few months however might be longer.

- Investor attitudes have so much to do with the way in which markets carry out — traders would possibly really feel bullish, boosting inventory costs, or bearish, inflicting them to lower.

- In the end, your funding technique depends upon your private danger tolerance. Nonetheless, it’s usually clever to purchase low and promote excessive throughout a bull market and be cautious about investing in a bear market, as the danger stage is way greater.

Whether or not you’re an skilled investor or are simply getting began, understanding a bull vs. bear market might be beneficial data when making monetary choices. For extra data on investing, take a look at these guides outlining the best way to put money into shares and the best way to keep away from widespread investing errors.

Join Mint

-

Earlier Submit

Say Goodbye To Overdraft Charges