Cryptocurrency Definition

Cryptocurrency, aka crypto, is a digital foreign money that doesn’t depend on any financial institution or authorities, which means it’s decentralized. These currencies run on a blockchain, a decentralized public ledger that retains a safe document of crypto transactions.

Whether or not you’ve heard about folks utilizing crypto to purchase their groceries at Entire Meals or their espresso at Starbucks, cryptocurrency is a trending matter — and funding.

Actually, the worth of all cryptocurrencies is value trillions of {dollars} immediately.

Even should you’re among the many crypto-curious, you would possibly nonetheless be asking your self, “Simply how does cryptocurrency work?” Observe alongside to study crypto, its benefits and downsides, and finest practices for getting began with cryptocurrency safely.

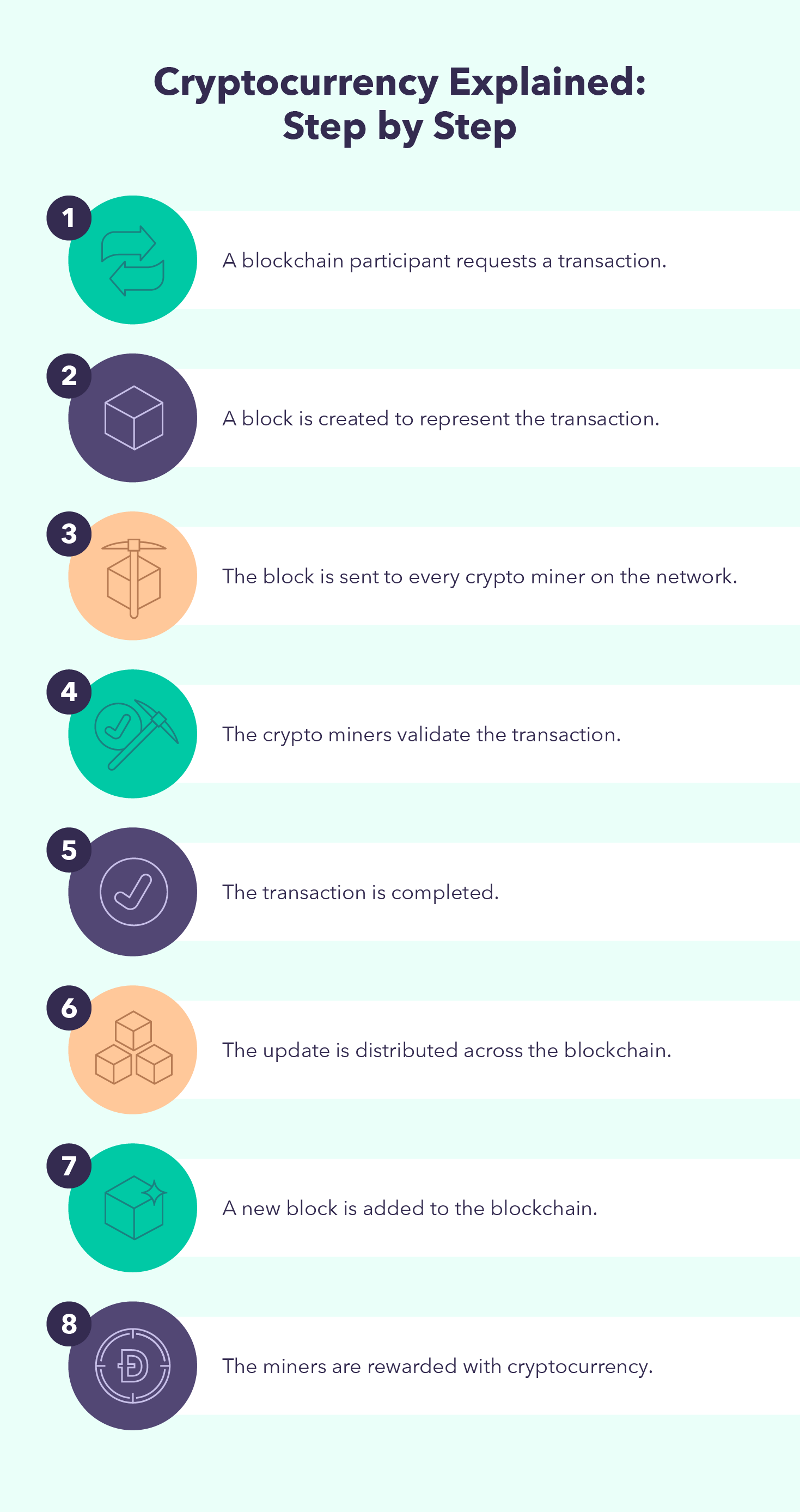

How Does Cryptocurrency Work?

Cryptocurrencies are decentralized digital currencies that stay on a blockchain. Not like bodily money, cryptocurrencies are intangible and will be exchanged digitally with others around the globe.

Now, you could be asking your self, “So, the place does crypto come from?”

Cryptocurrencies are created by a course of generally known as mining. When mining crypto, computer systems clear up complicated math issues to validate crypto transactions and generate new cash.

Crypto customers also can buy these currencies from brokers or on on-line exchanges. When you’ve bought crypto, you may retailer your cash both on-line or offline in a crypto pockets. Relying in your particular buying and selling wants, there are various forms of wallets to select from.

Whereas you should utilize crypto to pay for items and companies, many individuals make investments these currencies as a substitute. Crypto traders purchase and promote digital cash on-line, much like buying and selling shares. Within the U.S., cryptocurrencies are authorized and handled as monetary property within the eyes of the Inside Income Service (IRS). Due to this, you’ll pay capital positive factors tax on the rise in worth after promoting your crypto.

Cryptocurrency Examples

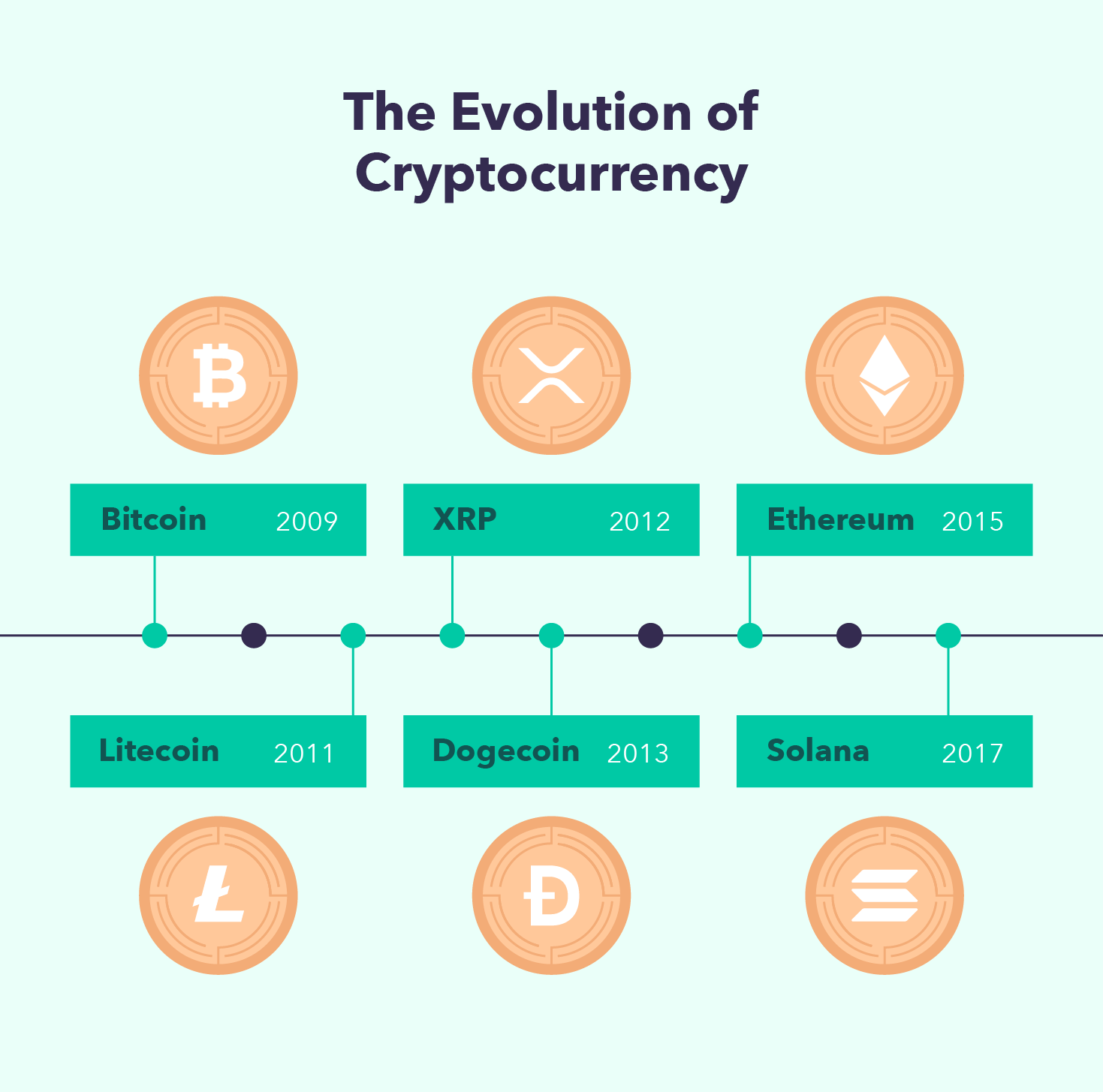

At present, there are over 19,500 totally different cryptocurrencies. Of those, listed here are the commonest examples of cryptocurrencies:

- Bitcoin: As the primary cryptocurrency ever invented, Bitcoin has grow to be one of the crucial common and beneficial cryptocurrencies.

- Litecoin: Created shortly after Bitcoin, Litecoin is the second cryptocurrency ever created. It was designed to enhance upon Bitcoin by having sooner transaction speeds.

- XRP: Because the native cryptocurrency of the Ripple digital cost community, XRP is praised for its fast and safe world transactions.

- Dogecoin: Initially began as a joke, Dogecoin has gained reputation and a cult following.

- Ethereum: Typically used for extra complicated transactions, Ethereum can be generally used for purchasing and promoting NFTs.

- Solana: A competitor to Ethereum, Solana is thought for its quick and low-cost transactions.

These are only a few of the choices you may presently spend money on. Let’s go over the benefits and downsides of cryptocurrency.

Benefits and Disadvantages of Cryptocurrency

| Professionals of Cryptocurrency | Cons of Cryptocurrency |

|---|---|

| Decentralization | Lacks full anonymity |

| Ease of use | Excessive volatility |

| Pace | Dangerous to atmosphere |

| Safety | Used for criminal activity |

Cryptocurrencies had been invented in hopes of revolutionizing our monetary world on the heels of the 2008 monetary disaster — and lowering the thickness of our wallets. As with every funding, utilizing cryptocurrency has its professionals and cons. Earlier than diving in, let’s take a look at a few of the benefits and downsides of cryptocurrency.

Benefits of Cryptocurrency

As a crypto person, you’ll by no means must stroll round with a pocket filled with unfastened change. As well as, there are different distinctive benefits to utilizing crypto.

- Decentralization: Cryptocurrencies are completely decentralized. Due to this, you don’t have to fret a couple of single entity, like a financial institution or authorities, inflicting a large-scale monetary disaster.

- Ease of use: You’ll be able to simply switch funds to different events with out the assistance of a financial institution or bank card firm.

- Pace: Since you received’t be utilizing any third-party intermediaries, you’ll be capable to switch cryptocurrency a lot sooner than a conventional cash switch.

- Safety: The blockchain expertise that cryptocurrency depends on is very safe, offering you with the peace of thoughts that your crypto is protected.

Whereas crypto actually has its upsides, there are nonetheless a couple of kinks that should be labored out earlier than it’s as extensively accepted as conventional currencies.

Disadvantages of Cryptocurrency

Like every foreign money, crypto isn’t good. Listed here are a few of the downsides to utilizing cryptocurrency:

- Lacks full anonymity: Though cryptocurrencies are typically talked about as completely nameless, that isn’t precisely the case. Whereas your transaction historical past received’t be linked to your title, authorities businesses can nonetheless monitor monetary exercise hooked up to your crypto tackle.

- Excessive volatility: The values of cryptocurrencies have a tendency to vary quickly. Due to their excessive volatility, you could be taking a big danger when investing.

- Dangerous to the atmosphere: As a result of electrical energy required to mine crypto, it’s estimated that Bitcoin alone is liable for over 114 million tons of carbon dioxide a 12 months.

- Used for criminal activity: Though it’s attainable to hint cryptocurrency transactions, many criminals have used crypto as a safer different to conventional foreign money for making unlawful transactions or laundering cash.

When weighing the professionals and cons of crypto, take into account your particular spending and investing wants.

Methods to Buy Cryptocurrency Safely

Now that you know the way crypto works, you could be questioning how one can buy it. Earlier than getting began with cryptocurrency, observe these 4 easy steps to make sure you’re shopping for crypto safely.

Step 1: Select a Cryptocurrency Platform

Step one when entering into cryptocurrency is deciding which platform to make use of. Usually, you should purchase crypto in two methods:

- Conventional brokers: On-line brokerages supply alternative ways so that you can purchase and promote crypto. These brokers may additionally present different monetary property equivalent to shares and ETFs. Often, all these brokers have fewer crypto-friendly options and cheaper buying and selling prices than crypto exchanges.

- Cryptocurrency exchanges: These platforms are particularly designed for purchasing and promoting crypto. They typically help many several types of cryptocurrency and embrace pockets storage and account choices the place you may earn curiosity. Some platforms might cost utilization charges.

Step 2: Determine How You’ll Pay

As soon as you choose a cryptocurrency platform, you could then resolve tips on how to pay on your crypto. Most crypto traders use fiat currencies such because the U.S. greenback. Whereas beginning, you’ll probably use your debit or bank card to buy cryptocurrency. If you happen to’d moderately not use a card, many change platforms additionally help digital cash transfers throughout the automated clearing home (ACH) community in addition to wire transfers.

After you grow to be extra accustomed to crypto investing, you could resolve to make use of your present crypto to purchase different forms of cryptocurrency. For instance, you could use Bitcoin to buy Ethereum or vice versa.

Step 3: Add Credit score to Your Account

After you determine which cost methodology is finest for you, you’ll then switch the cash into your account. Additionally it is necessary to notice that totally different exchanges and brokerages might have charges for purchasing and promoting crypto. To make sure you aren’t hit with any surprises, make sure to analysis the charges related together with your chosen crypto platform.

Step 4: Choose a Cryptocurrency

Now that you’ve cash in your pockets, you can begin on the lookout for totally different crypto property. Relying on the crypto platform you utilize, you will have entry to dozens of several types of cryptocurrency. Whereas crypto expertise is safe, the cash themselves will be unstable. If you happen to’re involved in regards to the security of crypto, make sure to spend time researching the coin and platform you intend to take a position on.

5 Cryptocurrency Investing and Safety Ideas

It doesn’t matter what kind of funding you’re excited by, there are many folks making an attempt to make the most of traders with scams. Crypto scammers might attempt to idiot you by making faux web sites, organising digital Ponzi schemes, or posing as celebrities on-line.

In these scams, you’ll be promised vital assured returns in change for a small funding. In different scams, you’ll be fooled into pondering {that a} new cryptocurrency is the subsequent massive factor. After scammers recruit extra folks, they’ll drive up the worth after which promote their shares, profiting off you and others. To assist keep away from this, observe these 5 steps for investing in crypto safely.

1. Analysis Earlier than Investing

Earlier than you begin investing, it’s necessary to do your individual analysis on the buying and selling platforms and cryptocurrency you’re excited by. To assist decide, learn platform critiques and discuss to different traders. This might help make sure that your cash and crypto are in protected arms.

2. Correctly Retailer Crypto Property

If you happen to personal crypto, it’s essential that you just retailer it correctly. Relying in your private choice and safety wants, there are various alternative ways to retailer your crypto. Listed here are some frequent crypto storage choices:

- On-platform storage: Many traders decide to go away their crypto property on the change platform they purchased them on. This permits for a fast and simple expertise when buying and selling cryptocurrency. It’s necessary to notice, nonetheless, that your crypto could possibly be in danger if the change platform has a safety breach.

- Sizzling pockets: These wallets are web-based and related to the web. When utilizing a scorching pockets, you may simply and rapidly switch your crypto wherever you want it. Due to their on-line connectivity, scorching wallets are much less safe than chilly wallets.

- Chilly pockets: Often known as an offline pockets, one of these pockets is far more safe than a scorching pockets. Chilly wallets are small {hardware} gadgets that retailer your crypto offline. With a chilly pockets, your funds can’t be touched with out entry to your bodily pockets gadget. As a result of they’re offline, it’s a far more time-consuming course of to switch funds on-line.

With many various storage choices out there, make sure to do your analysis and choose one which finest aligns together with your asset worth and buying and selling wants.

3. Diversify Your Cryptocurrency Investments

Diversifying your property is an important a part of any profitable funding technique. When investing in crypto, make sure to not put your whole eggs in a single basket. For instance, investing your whole cash right into a single cryptocurrency could possibly be dangerous. As a substitute, it might be safer to unfold your cash out throughout a couple of totally different cryptos you belief.

4. By no means Share Your Keyphrase

Shopping for and promoting cryptocurrency requires a personal keyphrase. This keyphrase is required to commerce crypto and show possession of your crypto property. Similar to any password to a web based account, it’s essential that you just by no means share it with anybody. If somebody figures out your keyphrase, they will do no matter they need together with your crypto.

It’s additionally very important that you just by no means lose your keyphrase. With out your non-public key, you’ll lose entry to your whole cryptocurrency, subsequently shedding your funding.

5. Know the Dangers of Making Investments

Earlier than you begin crypto investing, make sure to take into account your funding objectives. As with every kind of investments, it’s necessary that you just perceive your danger tolerance, as you might lose your cash. Due to this and crypto’s excessive stage of volatility, make sure to make investments responsibly.

Now that you just perceive how cryptocurrency works and a few of the crypto-related terminology, you would possibly take into account taking the leap from being crypto-curious to a newbie crypto investor — get began by selecting the best crypto platform for you. Blissful mining!

Join Mint

Cryptocurrency FAQs

Have extra questions alongside the strains of, “How does cryptocurrency work?” Now we have solutions.

A blockchain is a shared and distributed digital public ledger that’s utterly decentralized. When it comes to crypto, a blockchain shops an entire document of crypto transactions. In different phrases, a blockchain is a safe method of recording transactions that’s unattainable to vary.

“The purpose of cryptocurrency is to offer a faster, simpler, and safer different to conventional currencies. It was designed to enhance upon conventional foreign money by being utterly decentralized and giving energy to the crypto holder moderately than a financial institution or authorities entity.

Crypto traders generate income by promoting their crypto at the next worth than after they bought it. For instance, should you purchased a single Litecoin in July 2021 when its worth was $107.30, you would possibly’ve thought of promoting it in November 2021 when its worth went as much as $279.36. You’ll’ve made $172.06 from the sale.

Cryptocurrency could also be an excellent funding when you have a comparatively excessive danger tolerance. Compared to different investments equivalent to shares or bonds, cryptocurrency costs are far more unstable. Due to this, cryptocurrency might not be the very best funding possibility for individuals who choose low-risk investments.

Within the U.S., cryptocurrency is acknowledged as a monetary asset however not as authorized tender. You’ll be able to nonetheless use crypto to purchase items and companies wherever it’s accepted and you may simply change it for U.S. {dollars}.

Cryptocurrency is mined utilizing computer systems and superior software program designed particularly for mining new cash. When mining, these computer systems clear up difficult math issues that assist validate crypto transactions on the blockchain. This course of prevents the opportunity of the identical crypto being spent twice.

The homeowners of the mining {hardware} are then rewarded with new cash for his or her assist conserving every little thing safe. This course of is called proof of labor, and results in the technology of latest cash that may later be in circulation and out there for buying and selling.

After promoting your crypto, you may pull your cash out by transferring the steadiness out of your brokerage account or change platform to your checking account.

It’s necessary to notice that totally different brokers or change platforms might have totally different switch charges or necessities for withdrawing cash. Earlier than you begin investing, be sure you perceive the withdrawal course of and related charges of your chosen crypto platform.

A safety is a tradable monetary asset. Whereas it might look like crypto matches that definition, the U.S. Securities and Change Fee (SEC) acknowledges cryptocurrencies as commodities moderately than securities.

-

Earlier Publish

What Are The Hidden Charges of Crypto/NFTs?

-

Subsequent Publish

How To Make investments In The Metaverse