Chainlink is a decentralized oracle community aiming to combine on-blockchain sensible contracts with real-world knowledge saved off-blockchain. Every oracle supplies real-time knowledge feeds which may be linked to any decentralized software (DApp), whereas oracles in a community make sure that knowledge feeds keep decentralized, eliminating any considerations about dependability.

Chainlink is commonly utilized in DeFi lending and borrowing marketplaces like Aave and artificial exchanges like Synthetix. Though largely utilized in DeFi, this knowledge bridge has different makes use of, together with retrieving plane flight knowledge and delivering it to insurance coverage companies to allow automated insurance coverage claims.

The oracle community launched Chainlink Staking v0.1 in December 2022, introducing one other layer of crypto-economic safety on Chainlink. Staking allows ecosystem individuals to earn rewards whereas making certain the safety and credibility of oracle companies.

LINK is Chainlink’s native cryptocurrency for compensating node operators, incentivizing good actions, and as a popularity indicator for knowledge suppliers.

This put up will discover the sorts of staking within the Chainlink ecosystem, its advantages and dangers, and supply a information on the place and the best way to stake Chainlink tokens to start incomes curiosity in your staked LINK tokens.

What Is Chainlink Staking?

Chainlink is a decentralized oracle community that gives dependable, tamper-proof inputs and outputs for advanced sensible contracts on any blockchain. The community makes use of “safe aggregated value feeds” to make sure the information supplied by its oracles is correct and dependable. It allows a number of oracles to offer value knowledge for a similar contract, which is then aggregated and validated by a decentralized community of nodes. This mechanism ensures the information is correct and tamper-proof, as any try to govern the information would require management over a good portion of the community.

Staking inside decentralized oracle networks goals to create dependable and tamper-resistant oracle studies that precisely replicate the state of the exterior world.

Chainlink staking is the method of locking up LINK tokens to take part within the consensus mechanism of the Chainlink community and obtain rewards within the type of extra LINK tokens in return.

Staking is a vital facet of the Chainlink community, serving to safe the community and preserve its integrity. By staking LINK tokens, Chainlink ecosystem individuals basically commit their tokens as collateral to confirm any on-chain transaction on the community. This ensures the community stays decentralized and reliable.

Forms of Chainlink Staking

Chainlink affords the chance of staking LINK tokens within the Chainlink staking v0.1 staking pool. The staking pool might turn out to be bigger because the community grows and accommodates extra group members. Chainlink plans on introducing the v0.2 staking pool in round 9 -12 months from December 2022.

Chainlink staking allows ecosystem individuals, together with node operators and group members, to extend the safety ensures and consumer assurances of oracle companies by backing them with staked LINK tokens. Let’s look into the principle sorts of Chainlink staking beneath.

A consumer can select to help the broader enlargement of the Chainlink infrastructure by turning into a node operator. Node operators should maintain a certain quantity of LINK tokens as collateral, which helps make sure that they’ve a monetary stake within the community’s success. In trade for his or her companies, node operators obtain a share of the transaction charges generated by the community.

Node operators collect and switch knowledge to sensible contracts whereas managing the infrastructure that retains Chainlink operational and working across the clock. The rating of a node within the Chainlink system will increase with the variety of LINK tokens held by the node.

LINK token holders want in depth technical data and expertise to create a node within the Chainlink community.

Be aware: In accordance with the Chainlink workforce, Node Operator Stakers wouldn’t see their dedicated stake slashed throughout Chainlink staking v0.1. Nonetheless, as much as three months of accrued staking rewards have been slashed from node operators serving the ETH/USD Information Feed on Ethereum on account of a doable legitimate alert. Rewards of actively staking node operators not serving the ETH/USD Ethereum Information Feed weren’t slashed throughout v0.1

Group stakers are LINK token holders who take part in Chainlink staking to assist safe and preserve the community. Group stakers might select to function their very own Chainlink node or delegate their tokens to an current node operator. As a reward for his or her contribution, they obtain a share of the transaction charges generated by the community.

Group stakers play a vital position within the success of the Chainlink community, serving to make sure the community is decentralized and safe. By holding and staking their LINK tokens, they assist to incentivize the right functioning of the community and preserve the integrity of the information being transferred by means of it.

Chainlink has an lively group of stakers devoted to the community’s long-term success. The group contains particular person customers and bigger institutional traders supported by a variety of staking platforms and assets supplied by the Chainlink workforce.

Chainlink Staking Platforms

A number of Chainlink staking platforms and assets can be found to customers desirous to take part in staking LINK tokens. Some examples embody:

- Official Chainlink Staking Platform: That is the official staking platform supplied by the Chainlink workforce. It permits customers to stake their LINK tokens and turn out to be node operators on the community, incomes rewards for validating knowledge requests and sustaining the community’s safety.

- DeFi Staking: A number of DeFi platforms enable customers to stake their LINK tokens in trade for rewards. For instance, the Aave protocol will allow customers to stake LINK and earn curiosity on their holdings, whereas the Synthetix protocol permits customers to stake LINK as collateral and earn rewards within the type of SNX tokens.

- CeFi Staking: Centralized exchanges (CeFi) is one other solution to stake LINK and earn rewards. These platforms, comparable to BlockFi or Nexo, earn curiosity on the deposited LINK and supply a extra user-friendly and accessible staking expertise than DeFi platforms. Nonetheless, the variety of exchanges supporting LINK staking is proscribed.

A number of the hottest Chainlink staking platforms are listed within the video beneath:

Chainlink Staking Advantages

Staking Chainlink contains a number of advantages listed beneath:

- Passive earnings: Staking LINK tokens enable customers to earn passive earnings. They’re rewarded within the type of further LINK tokens for validating transactions on the Chainlink community.

- Elevated safety: Staking helps to extend the safety and reliability of the Chainlink community by incentivizing customers to behave within the community’s finest curiosity. Validators are required to stake a certain quantity of LINK tokens, which they threat shedding in the event that they act maliciously. This encourages validators to behave truthfully and helps forestall community assaults.

- Decentralization: Staking promotes decentralization on the Chainlink community by permitting anybody with LINK tokens to take part within the validation course of. This helps forestall just a few massive entities’ centralizations of energy and management.

- Repute: Staking LINK tokens additionally assist to construct a popularity throughout the Chainlink community. Validators who constantly validate transactions precisely and truthfully are rewarded with a very good popularity, rising their possibilities of being chosen as validators.

- Liquidity: Staking LINK tokens additionally present liquidity to the Chainlink community. By locking up LINK tokens, customers cut back the variety of LINK tokens accessible for buying and selling, which can assist stabilize the LINK token value and cut back market volatility.

Chainlink Staking Dangers

- Your tokens are used as collateral when staking Chainlink. If the node you chose supplies incorrect info or violates the service settlement, chances are you’ll lose a portion of your staked tokens. Moreover, since this can be a new know-how, staking might have unexpected dangers.

- Earlier than staking, making certain cryptocurrency is authorized in your nation is important. Plus, you will need to think about the tax implications of staking rewards, as they might be taxable in some jurisdictions as rental or curiosity earnings.

Whereas Chainlink hasn’t suffered any public bugs or points, it’s topic to any bugs or points that will come up on Ethereum. Nonetheless, Chainlink has carried out a bug bounty program to assist establish and tackle any potential points.

The way to Stake LINK?

Staking LINK is a comparatively easy course of. Right here’s a step-by-step information on the best way to stake LINK:

- Get hold of LINK Tokens: Step one is to accumulate LINK tokens. You should buy LINK on varied cryptocurrency exchanges, comparable to Binance, Coinbase, or Kraken.

- Set Up a Pockets: Subsequent, you will need to arrange a pockets that helps staking LINK. You’ll be able to select from a number of wallets, together with MetaMask, Ledger, and Trezor. Good contract wallets are additionally supported. Guarantee your pockets is Ethereeum-based and suitable with the staking platform you intend to make use of.

- Select a Staking Platform: Choose a staking platform that helps LINK staking, together with Binance, Kraken, Celsius, and many others. Test the platform’s staking necessities, rewards, and charges to decide on a platform that meets your wants and preferences.

- Deposit LINK: When you’ve chosen a staking platform, deposit your LINK tokens into the platform’s staking pockets. Comply with the deposit directions fastidiously.

- Begin Staking: After depositing your LINK, you can begin staking. Select the staking choice that fits you finest, whether or not it’s a fixed-term or versatile staking choice. Your staking rewards will rely upon the staking choice you select and the quantity of LINK you stake.

- Monitor Your Staking Rewards: You’ll be able to monitor your staking rewards in real-time by means of your chosen staking platform. At all times maintain monitor of your rewards and modify your staking technique as wanted.

Step-by-Step Information for Staking Chainlink With Metamask

You’ll be able to stake Chainlink (LINK) tokens utilizing Metamask, a well-liked Ethereum pockets that enables customers to work together with decentralized functions (DApps) and carry out varied blockchain operations, together with staking.

Metamask is a browser extension that may be added to Google Chrome, Firefox, and Courageous browsers and a self-custodial pockets, that means customers have full management over their non-public keys and funds.

To stake Chainlink with Metamask pockets, you will need to have your pockets related to a staking platform that helps LINK staking, such because the official Chainlink staking platform or a third-party platform.

Right here’s a step-by-step information for staking LINK tokens by means of the Metamask pockets.

- Open your browser and go to the Chainlink Staking net web page. Test the URL to make sure you are on the right staking web site.

- Click on the “Join Pockets” button within the web page’s top-right nook.

- Select Metamask as your pockets and guarantee you may have sufficient LINK tokens and ETH for transaction gasoline charges.

- Choose the pockets account that has the LINK tokens you wish to stake. Customers with just one account can choose the one choice for connecting their wallets. However, customers with a number of accounts on Metamask should click on on the pockets tackle with the LINK tokens. Now you possibly can click on “Subsequent” to attach it to the staking net web page.

- Click on “Join” to attach your pockets tackle to the staking net web page. Yow will discover your related pockets addresses within the top-right nook of the web page.

- Select the variety of LINK tokens you wish to stake. Guarantee you may have sufficient LINK in your pockets and don’t exceed the “Accessible to stake” tab quantity.

- Click on “Stake LINK” to begin the staking course of. Evaluation the phrases of service and click on “Settle for and proceed” to proceed.

- Metamask will open up and ask on your permission to substantiate the transaction. Test the ETH quantity for the community transaction price and click on “Affirm” to ship the staking transaction request to Ethereum.

- Await affirmation. The affirmation time is determined by gasoline costs and community exercise. When you see the “Transaction full” message, you possibly can view your transaction on Etherscan.

Staking Chainlink on Binance

Step 1 – Create a Binance account and log in.

Step 2 – Head over to Binance Earn and choose both Versatile Financial savings or DeFi Staking. You’ll discover these choices beneath the “Earn” tab on the highest menu bar.

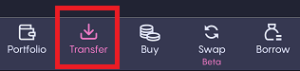

Step 3 – Subsequent, click on “Switch” from the dropdown menu and fill within the essential info.

Step 4 – When you’ve supplied all of the required particulars, click on “Lockup” to substantiate your switch.

It’s necessary to notice which you could withdraw your funds from Versatile Financial savings at any time. Nonetheless, staking in DeFi may require conserving your funds locked for the whole lockup interval. The curiosity earned will likely be calculated and paid out day by day primarily based in your efficiency.

Staking LINK on Kucoin

To stake LINK on Kucoin, observe these steps:

- Create an account on Kucoin.

- Go to the “Deposit” part of the menu and select LINK from the dropdown listing.

- Copy the Deposit Deal with and switch your tokens to Kucoin.

- After the transaction is full, click on “Stake Now.”

- Select the variety of LINK tokens you wish to stake and click on “Affirm Stake.”

- You’ll be able to verify your staked LINK within the “My Stakes” part of the web page.

Kucoin pays out rewards day by day and lets you withdraw your tokens anytime.

Staking LINK on BlockFi

Comply with the steps described beneath to begin incomes rewards by staking Chainlink on BlockFi:

- Create a BlockFi account and log in.

- Click on on “Deposit” and choose LINK from the listing of choices.

- Copy the Deposit Deal with and use it to switch your tokens to BlockFi.

- Click on “Stake Now” as soon as the transaction is accomplished.

- Choose the quantity of LINK you wish to stake and click on “Affirm Stake.”

- Test the “My Stakes” part of the web page to view your staked LINK.

BlockFi pays out rewards weekly and allows you to withdraw your tokens anytime.

The way to Earn Chainlink Staking Rewards?

To earn Chainlink staking rewards, you will need to stake your LINK tokens with a platform that provides staking rewards.

You can too use the Chainlink Staking app, a decentralized software (DApp) with a user-friendly interface that lets customers simply stake their tokens on the Chainlink community and monitor their rewards. To make use of the Chainlink Staking app, customers will need to have a pockets that helps LINK tokens and lock up their tokens for a specified interval. The app supplies customers.

Listed below are the final steps for staking:

- Select a platform that helps Chainlink staking, comparable to Binance, Kucoin, or BlockFi.

- Create an account and full any essential verification necessities.

- Deposit your LINK tokens into the staking platform.

- Choose what number of LINK you wish to stake.

- Affirm the staking transaction.

- Await the staking interval, throughout which you’ll earn staking rewards.

- Withdraw your staked LINK and earned rewards anytime.

Notably, completely different staking platforms might have completely different staking necessities, rewards, and withdrawal procedures. Earlier than staking your LINK tokens, verify the minimal LINK threshold and perceive the platform’s phrases and circumstances.

The way to Stake LINK on Celsius?

Celsius is a well-liked crypto borrowing and lending platform enabling customers to earn curiosity on a variety of cryptocurrencies. With Celsius, incomes curiosity is straightforward – all it’s worthwhile to do is retailer the cryptocurrency in your Celsius pockets with out locking it up.

Desktop Model

- Go to the Celsius web site at https://celsius.community/ to create an account.

- After organising your account, go to your dashboard and search for Chainlink (LINK).

- For those who don’t see LINK in your listing of cash, click on on the “Obtain” tab, then click on “Add New Cash,” and choose Chainlink (LINK). The coin will then seem in your listing, and you may click on “View and Copy Deal with.“

- Ship your LINK to the tackle supplied by Celsius.

- As soon as Celsius receives your LINK, you’ll begin incomes curiosity instantly, with rewards distributed weekly. There is no such thing as a must lock up your cryptocurrency.

Cellular Model

- Obtain the Celsius app out of your cell gadget’s app retailer (accessible for Android and iOS).

- Open the app and create an account by clicking “Be part of Celsius.”

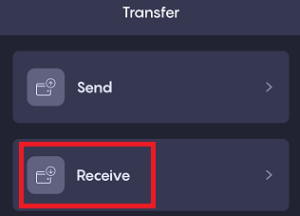

- As soon as your account is about up, click on the “Switch” tab to view your choices.

- Select “Obtain.”

- Choose Chainlink (LINK) from the listing to get your LINK tackle.

- When you obtain your LINK, you’ll begin incomes curiosity instantly, with rewards distributed on a weekly foundation.

Closing Ideas

Chainlink token holders have many prospects to stake their idle LINK tokens to generate passive earnings.

Staking LINK tokens by means of an trade is by far the best various, though the advantages may be modest. DeFi companies are extra worthwhile choices however want extra planning and data gathering. Whereas turning into a Chainlink node operator is an choice, it’s technically difficult, and many individuals discover the strategy extremely inefficient for the incentives earned.

Chainlink staking will present further functionalities sooner or later, comparable to consumer price rewards, a extra superior popularity system, complete stake-slashing mechanics, and elevated safety assurances.

Disclaimer: All info supplied in or by means of the CoinStats Web site is for informational and academic functions solely. It doesn’t represent a advice to enter into a specific transaction or funding technique and shouldn’t be relied upon in investing determination. Any funding determination made by you is totally at your personal threat. In no occasion shall CoinStats be chargeable for any incurred losses. See our Disclaimer and Editorial Pointers to be taught extra.