Cryptocurrency traders worldwide benefit from the revenue created by means of crypto staking rewards, an revenue paid to crypto homeowners who lock up their digital tokens for a sure interval to contribute to the efficiency and security of the blockchain community. Many DeFi protocols supply nice incentives for many who stake crypto and lock them into dangerous good contracts by offering curiosity on funding and governance tokens.

To earn rewards, you need to take part in Staking. The Binance staking reward system for eligible cryptocurrency permits you to accumulate extra cash because the Binance algorithm optimizes staking alternatives.

Binance alternate is among the greatest crypto staking platforms supporting almost 100 totally different staking cash. On this evaluation, we’ll dive deep into the Binance DeFi staking alternate, exploring the alternate’s staking choices, supported crypto cash, and so on., and discover ways to stake on Binance.

Let’s get began!

What Is Staking

Typically it’s possible you’ll simply HODL your cryptocurrency on an alternate or a pockets, and it doesn’t earn you any cash. Nicely, the staking course of provides you each HODL your cryptocurrency and earn a return in your funding. Staking is a well-liked option to generate further revenue together with your cryptocurrencies in the event you plan to carry them for a selected interval.

Most main cryptocurrency exchanges supply staking, permitting customers to earn passive revenue for holding their cryptocurrency on the alternate.

Staking solely applies to blockchains that make the most of the Proof-of-Stake (PoS) consensus mechanism, wherein Staking is used to validate transactions. It includes allocating accountability in sustaining the general public ledger to a participant node in proportion to the variety of digital foreign money tokens it holds. In brief, anybody holding a required variety of cash can earn staking rewards and take part in validation, i.e., confirm transactions as wanted. In consequence, crypto holders typically select to stake cash within the hope of incomes curiosity as a substitute of buying and selling them.

Those that stake their crypto in a PoS blockchain are known as validators. Validators present worth to the community by locking belongings for an agreed-upon ‘staking interval’ and earn rewards in return. PoS validators are chosen based mostly on the upper variety of staked cash.

Staking Swimming pools

People can begin staking if they’ve sufficient belongings wanted to change into a validator on the blockchain community. Nevertheless, they will use staking swimming pools in the event that they need to take part within the staking exercise with out having to stake massive quantities of a crypto token. A staking pool is a device permitting stakeholders to pool of their tokens to offer the staking pool operator a validator standing and earn staking rewards for his or her computational assets’ contributions.

For instance, staking on the Ethereum Community requires 32 ETH tokens, which equals roughly $40,000 and could be difficult for the typical investor.

Binance Staking

Binance is among the world’s largest cryptocurrency exchanges, working in over 180 nations. Binance alternate just isn’t obtainable within the U.S.; as a substitute, folks can use Binance. U.S. Nevertheless, in the event you’re a U.S. resident, you may nonetheless discover ways to use Binance by trying out our CoinStats weblog.

Binance is among the greatest crypto staking platforms for traders seeking to earn excessive rewards. Binance helps round 100 staking cash, overlaying a variety of tasks and APYs. Furthermore, Binance provides varied staking intervals starting from 10,30, 60, or 90 days.

With Binance, you may stake with a number of totally different options, together with:

Locked Staking, i.e., holding your funds in a pockets to assist the blockchain’s operations.

DeFi Staking, i.e., taking part in several DeFi merchandise through the Binance alternate.

Locked Staking

Picture from Binance.com

Binance locked staking is a course of the place you lock your funds for a specific amount of days to generate an curiosity yield. Presently, there are 5 totally different cryptocurrencies obtainable for Locked Staking, together with BNB (BNB), NKN (NKN), Kusama (KSM), Moonbeam (GLMR), and EOS (EOS). A set minimal quantity for every is required for Staking, and the staking interval is from 14 to 120 days.

Right here’s a video that goes into extra particulars on Locked Staking: https://youtu.be/E8-18q0m0A0

The right way to Enter Locked Staking

You should join with Binance together with your e mail and password. Now, log in, search for Earn within the header menu, and click on on Binance Earn. Seek for your coin and examine for all obtainable choices, together with locked Staking, versatile Staking, and so on. You’ll be able to choose any choices for locked staking for 30, 60, and 90 days with separate curiosity returns.

DeFi Staking

DeFi staking on Binance options excessive APYs. You’ll be able to stake your cash in a liquidity pool to supply liquidity or in a protocol’s reward pool in return for rewards. DeFi staking provides improbable alternatives, however it additionally carries dangers, and for that reason, Binance vets their DeFi staking companions to reduce dangers to their prospects.

Binance Earn and ETH 2.0 Staking

Binance Earn is a function that allows you to earn passive revenue in your holdings. You normally need to stake your cryptocurrencies for 60 days to get the perfect staking curiosity.

Stake Ethereum ETH 2.0 on Binance

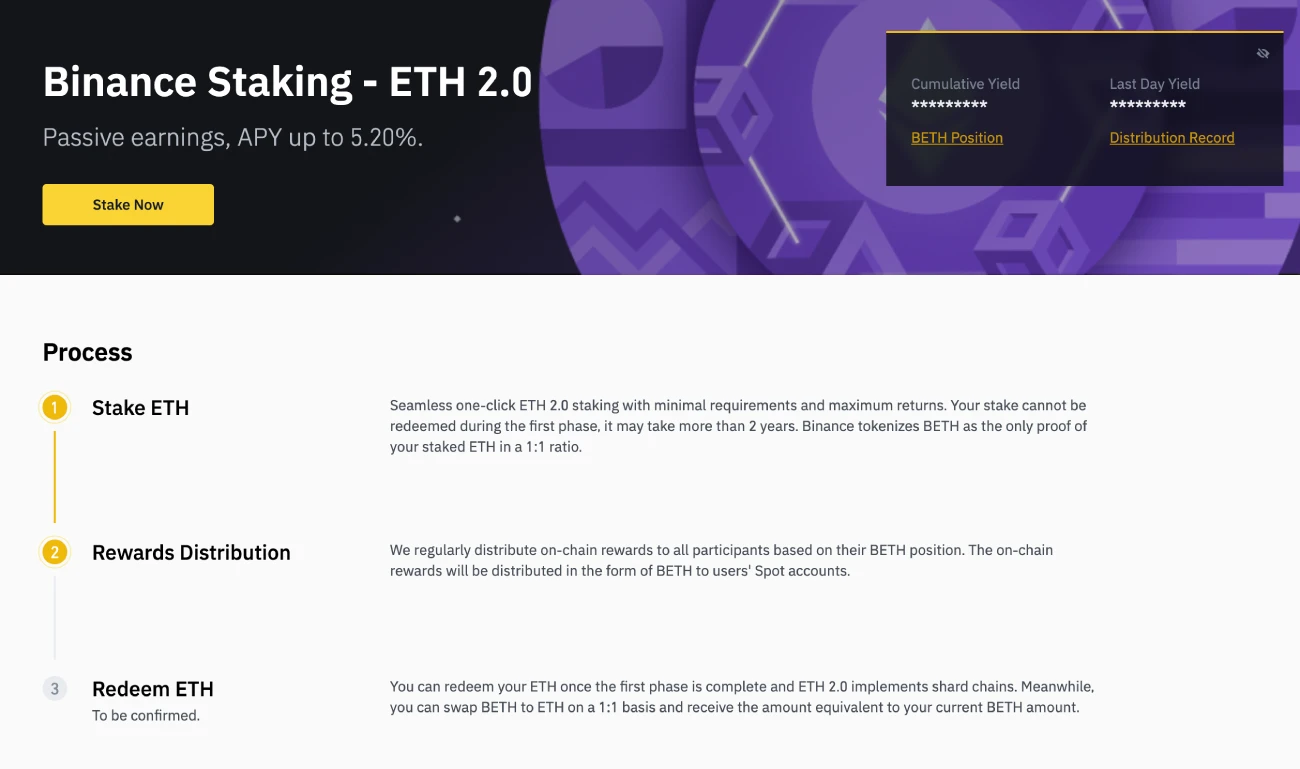

You’ll be able to stake Ethereum ETH 2.0 on Binance Earn for a small price. Right here’s Binance staking ETH 2.0 abstract:

- Minimal stake quantity: 0.0001 ETH

- Staking APY: 5%-20%

- Reward calculation: In the course of the ETH 2.0 staking interval, BETH rewards will likely be distributed every day based mostly on the person’s BETH holdings. Customers can commerce between ETH and BETH freely.

The right way to Stake ETH 2.0 With Binance

To stake on Binance, you want an account with Binance and an ETH stability.

- Enroll with Binance and deposit Ethereum

- Logín to your Binance account

- Go to Binance ETH 2.0 staking web page and click on on Stake now

- Enter the quantity for ETH 2.0 staking. Make sure that to learn the notes concerning your funds lock interval, which may be over 2 years.

- Learn all of the agreements fastidiously, examine the bins, and click on on the ultimate affirmation.Congratulations, you could have now efficiently staked into ETH 2.0!

DOT Slot Public sale

Binance’s DOT slot auctions help you take part within the Polkadot slot auctions and earn. In the course of the auctions’ open part, customers can stake their DOT holdings behind their favourite tasks. As soon as the open part is full, the community will determine the cut-off time for bids. The mission with essentially the most DOT staked behind it at this randomized cut-off time is the winner, and all of the DOT staked behind this mission is locked for 96 weeks. Throughout this lockup interval, the successful mission will distribute their tokens quarterly as a reward to their backers.

Moreover, Binance may even distribute BDOT tokens to all stakers at a 1:1 ratio. These BDOT tokens can be utilized whereas the DOT is locked in staking. If a mission didn’t win the slot public sale, then those that staked DOT in direction of the mission obtain their DOT again.

Listed below are the levels of the DOT Public sale:

1. Heat-up Interval. The nice and cozy-up interval is seven days to help you take a look at out the public sale.

2. Public sale Interval. Stake DOTs for the mission you need to assist.

3. Reward Distribution. Binance rewards 100% of the voting rewards to individuals.

The right way to Be a part of Binance’s DOT Slot Public sale

- High up in your DOT pockets stability

- Choose the PolkaDOT Public sale choice on the house web page

- Select the mission you need to vote for

- Click on vote for the mission you’d wish to vote for

- Set the quantity of DOT you’d wish to stake.

Actions Staking

This function on the Binance alternate permits you to earn rewards for staking a selected cryptocurrency for a selected staking interval. Actions staking course of lasts just for a selected interval. You’ll be able to examine the Actions part on Binance as these provides fluctuate month-to-month.

Locked Financial savings In Binance

You’ll be able to lock your funds on Binance for a various rate of interest relying on the locking interval. For example, you may lock your BUSD, USDC, or USDT for 7 days for a 4.5% AIR or 90 days for a 5.1%.

Binance Vault

You’ll be able to lock your BNB and earn an APY with Binance’s BNB vault part. The Binance Vault invests your funds in locations with assured yield, such because the launch pool or versatile saving.

Binance Launchpad

The Binance Launchpad options a number of tasks to permit customers to stake their cash to earn rewards. The checklist of tasks obtainable for Staking is continually altering.

Staking on Binance.US

Whereas the worldwide Binance alternate provides over 100 totally different cryptocurrencies for Staking, Binance.US solely provides 4: Vechain, Tezos, Cosmos, and Algorand, resulting from U.S. regulation.

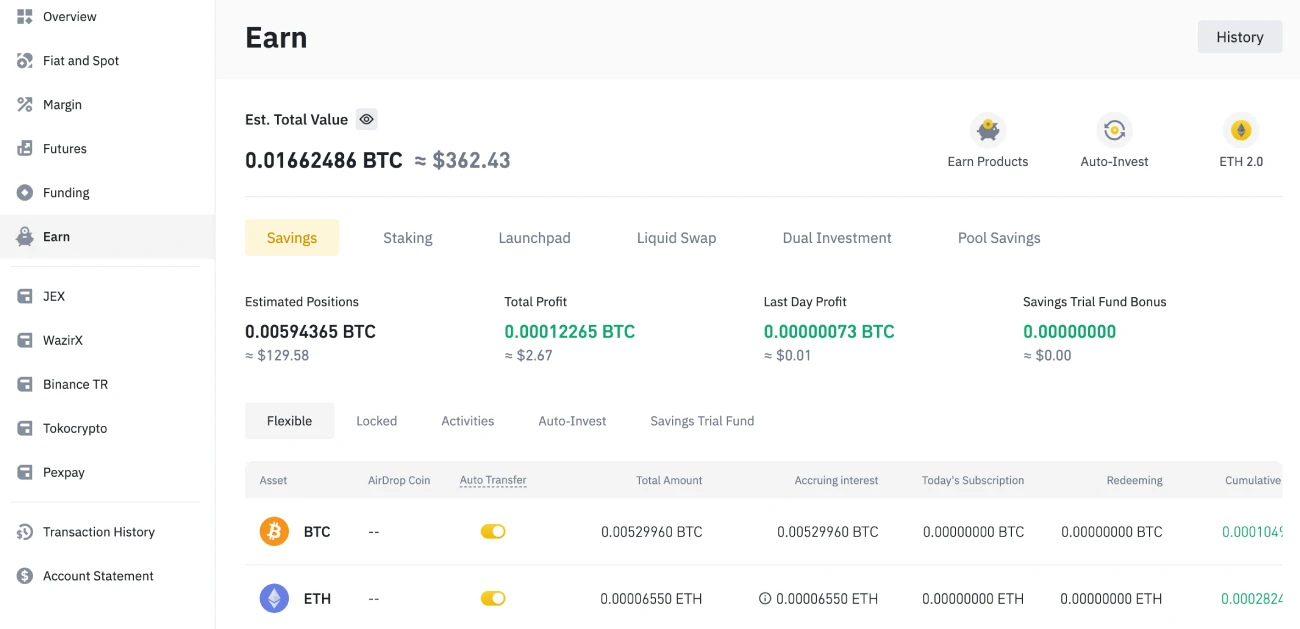

Binance Earn

Binance Earn permits you to earn in your crypto holdings. Binance Earn consists of:

Locked Financial savings

Fastened Financial savings supplies you with excessive rates of interest due to the mounted rate of interest and time period. You’ll be able to have your funds locked from seven to ninety days to earn a better APY.

Versatile Financial savings

Versatile Financial savings supplies glorious flexibility in enabling you to earn curiosity in your funds. You’ll be able to deposit your funds out of your Spot Pockets into your Versatile Financial savings account, earn curiosity, and have them redeemed anytime.

The right way to Stake on Binance

Now, let’s discover how one can begin staking crypto on Binance in a step-by-step information:

Step #1: Registration

To register a Binance account, go to the Binance official web site, and click on Register on the top-right nook. Affirm your residential nation and choose your account sort. Enter your e mail handle (or telephone quantity), and create a password. You’ll be requested to verify your e mail (or telephone quantity) by clicking the verification hyperlink you’ll obtain from Binance.

You have to full the KYC verification to get authenticated and begin staking. To finish the verification, you need to present a government-issued I.D. and private info. As soon as your software is reviewed and accepted, you may deposit and withdraw as much as $200k per day in fiat foreign money, deposit a limiteless quantity of crypto, have entry to altcoin or BNB staking, and so on.

Step #2: BNB Vault

Let’s first look into BNB staking because it’s totally different than staking different cash and tokens on Binance. Discover Earn on the highest menu and choose BNB Vault. All you want to do is have some BNB in your spot pockets, press Stake, and choose the quantity of BNB that you simply’d wish to stake.

You’ll be able to see your estimated APY on the top-left nook of the web page. Moreover, there’s additionally an choice to stake your BNB out of your spot pockets robotically.

The Binance staking rewards for BNB are excessive, and the staking course of itself is easy.

Notice that BNB staking isn’t obtainable on Binance. U.S.

Step #3: Locked Staking

In the identical Earn part, navigate to Staking, and also you’ll end up on the Locked Staking web page. There are over 100 cryptocurrencies obtainable for staking.

The estimated Binance staking rewards (APYs) differ relying on the redemption interval. Now, choose an asset, and press Stake to examine the abstract of your entire staking interval, your estimated good points, just a few disclaimers, and extra data. You should then enter the quantity of the asset that you simply’d like to begin staking, verify it, and begin incomes passive curiosity in your crypto!

Customers can select to redeem prematurely. After selecting early redemption, the principal will likely be returned to the spot account, and the distributed curiosity will likely be deducted from the refunded principal.

Step #4: DeFi Staking

Navigate to the DeFi Staking part of the platform that features fewer crypto belongings and the choice to decide on between a versatile lock, which means you may withdraw your belongings whenever you determine and locked Staking when your belongings will likely be locked for a chosen interval.

The staking course of is just like Locked Staking – you select an asset, examine all related info, enter the quantity you’d wish to dedicate to the DeFi swimming pools and ensure the stake.

Tip: Notice that VET, NEO, and ONT differ from different POS tokens. Staking VET rewards VTHO (NEO-GAS, ONT-ONG); subsequently, the curiosity just isn’t distributed every day. Between 00:00 – 04:00 (UTC) on the subsequent day after the product expires, customers’ staked NEO, VET, ONT, and earned GAS, VTHO, and ONG will likely be robotically transferred to the spot wallets.

Conclusion

Staking isa reliable option to earn some passive revenue in your crypto holdings. Nevertheless, Staking comes with sure dangers which can be minimized if selecting a dependable staking platform. Binance is among the many hottest and respected cryptocurrency exchanges and provides a easy and worthwhile staking course of for a variety of crypto belongings.

Moreover, Binance provides an automatic asset staking function for BNB staking.

Cryptocurrency traders seeking to take their buying and selling to the subsequent degree would require the service of a crypto portfolio tracker to maintain up with the tempo of the trade. CoinStats provides top-of-the-line crypto portfolio trackers available in the market, full of unbelievable options to assist merchants monitor all their holdings throughout totally different exchanges from one platform.

To be taught extra about DeFi’s tectonic shift within the finance world and the way decentralized finance empowers folks, you’re welcome to go to our CoinStats weblog. You’ll be able to learn our articles akin to What Is DeFi, discover our in-depth shopping for guides on varied cryptocurrencies, akin to The right way to Purchase SushiSwap, The right way to Purchase Cryptocurrency, and be taught extra about wallets, and cryptocurrency exchanges, portfolio trackers, and so on.

Funding Recommendation Disclaimer: No a part of the content material that CoinStats supplies constitutes monetary recommendation, authorized recommendation, or some other type of recommendation meant on your particular reliance for any function. Any use or reliance on our content material is solely at your individual danger and discretion. You need to conduct your individual analysis, evaluation, analyze and confirm our content material earlier than counting on them. Buying and selling is a extremely dangerous exercise that may result in main losses.