Final month, the Federal Reserve launched a brand new report: Financial Nicely-Being of U.S. Households in 2021 [PDF]. This annual survey gauges American monetary well being and attitudes. The 2021 version was carried out final November.

Listed here are some highlights from the report:

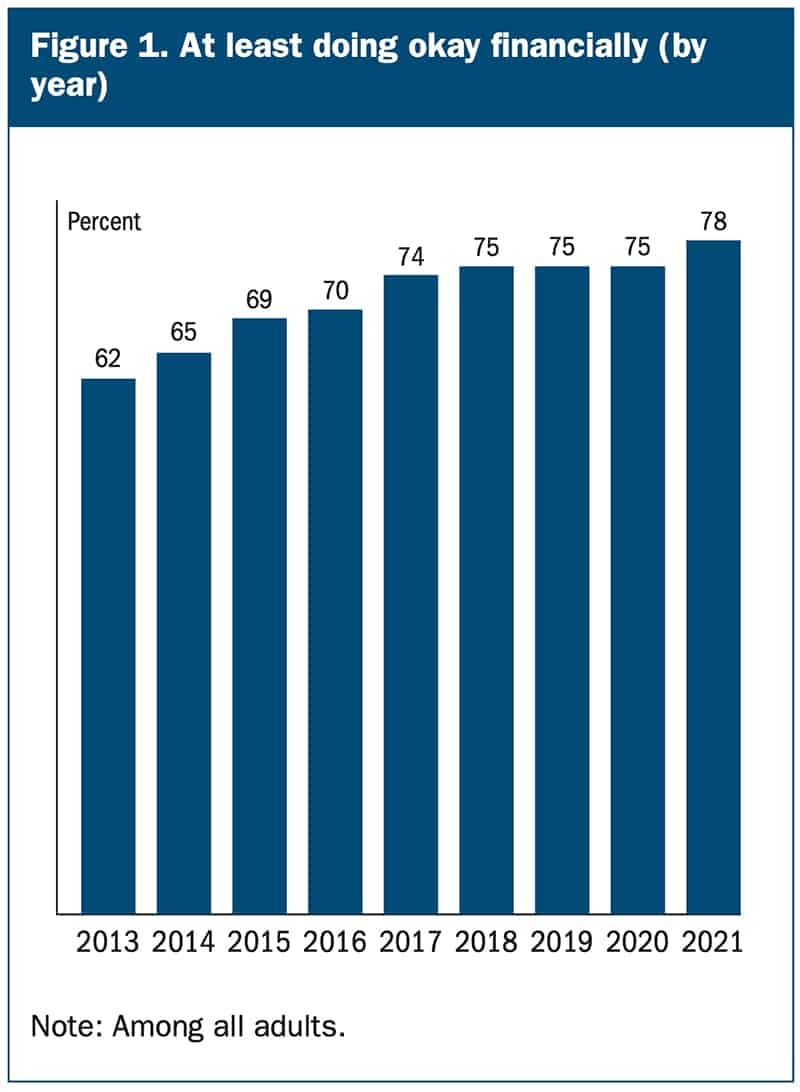

- Seventy-eight % of adults had been both doing okay or dwelling comfortably financially, the very best share with this degree of monetary well-being because the survey started in 2013.

- Fifteen % of adults with revenue lower than $50,000 struggled to pay their payments due to various month-to-month revenue.

- Fifteen % of employees mentioned they had been in a special job than twelve months earlier. Simply over six in ten individuals who modified jobs mentioned their new job was higher general, in contrast with one in ten who mentioned that it was worse.

- Sixty-eight % of adults mentioned they might cowl a $400 emergency expense solely utilizing money or its equal, up from 50 % who would pay this fashion when the survey started in 2013. (Observe that this survey is the unique supply of this oft-quoted statistic.)

- Six % of adults didn’t have a checking account. Eleven % of adults with a checking account paid an overdraft payment within the earlier twelve months.

These little nuggets of information are attention-grabbing, positive, however what I discover much more attention-grabbing are the charts and graphs documenting long-term developments.

The Demographics of Financial Nicely-Being

Right here, as an illustration, is a chart that exhibits how individuals really feel about their present monetary state of affairs:

In 2021, 78% of adults on this nation reported “doing okay” or “dwelling comfortably”. That is up considerably from when this survey began in 2013.

The following logical query, in fact, is how totally different demographics really feel about their monetary state of affairs. The Fed report presents some perception into that.

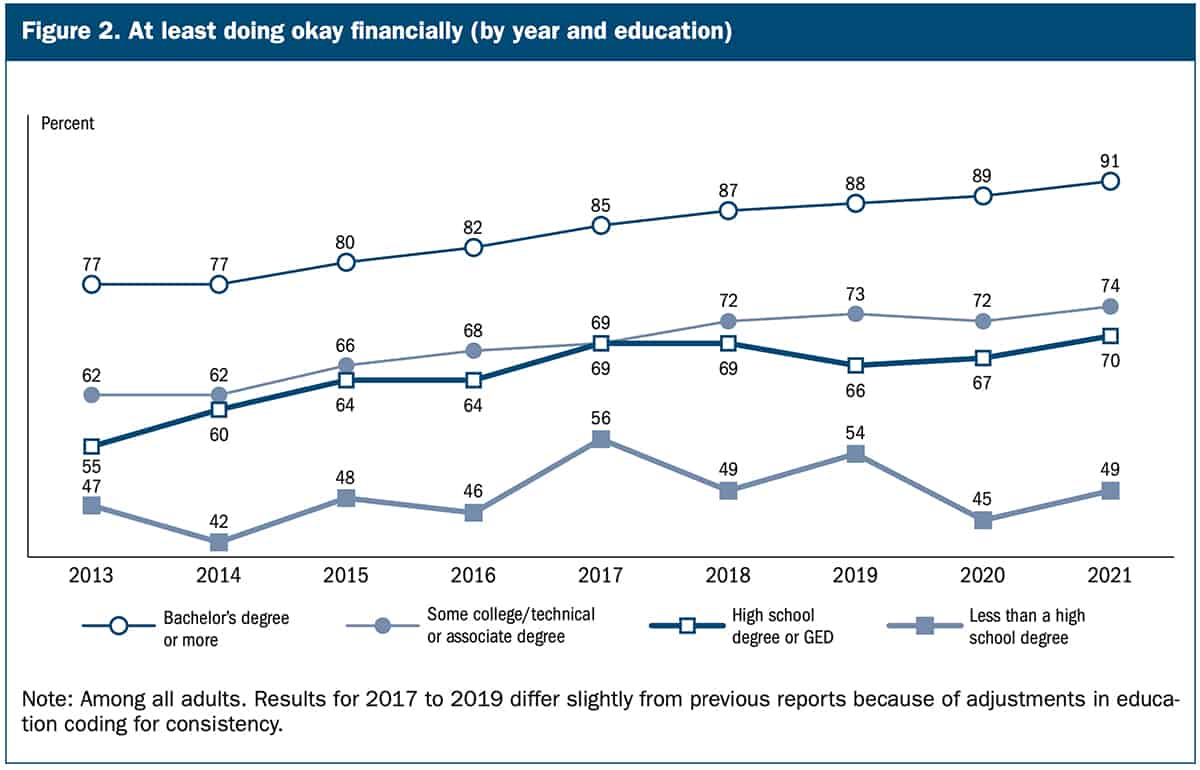

This is a chart that exhibits (as soon as once more) the worth of a faculty diploma).

Though it is standard in some corners to bad-mouth faculty levels, in line with the U.S. Census Bureau (and many different sources) your schooling has a better affect on lifetime incomes potential than some other demographic issue. Training issues greater than age. Training issues greater than race. Training issues greater than gender. Relating to earning profits, schooling issues most.

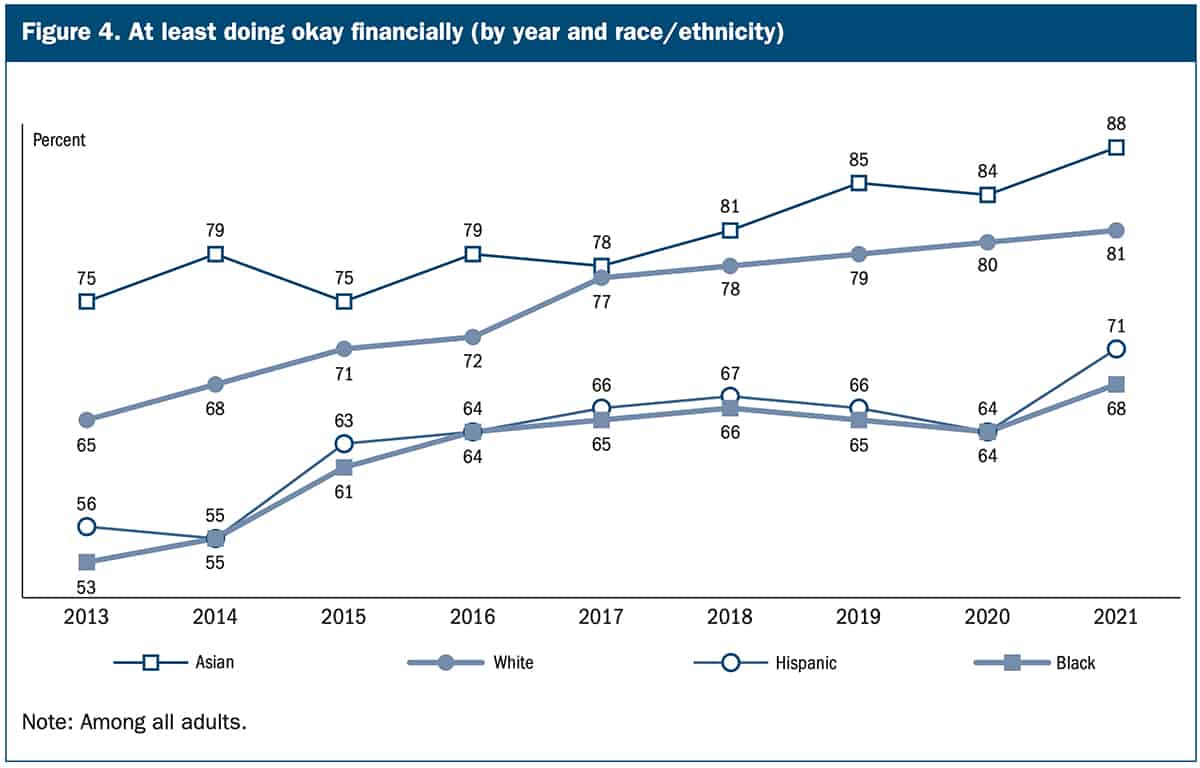

Subsequent, this is a chart from the Fed report that paperwork financial well-being by race and ethnicity:

It appears that evidently financial well-being has improved throughout the board in the course of the previous decade.

Private Nicely-Being Versus Nationwide Nicely-Being

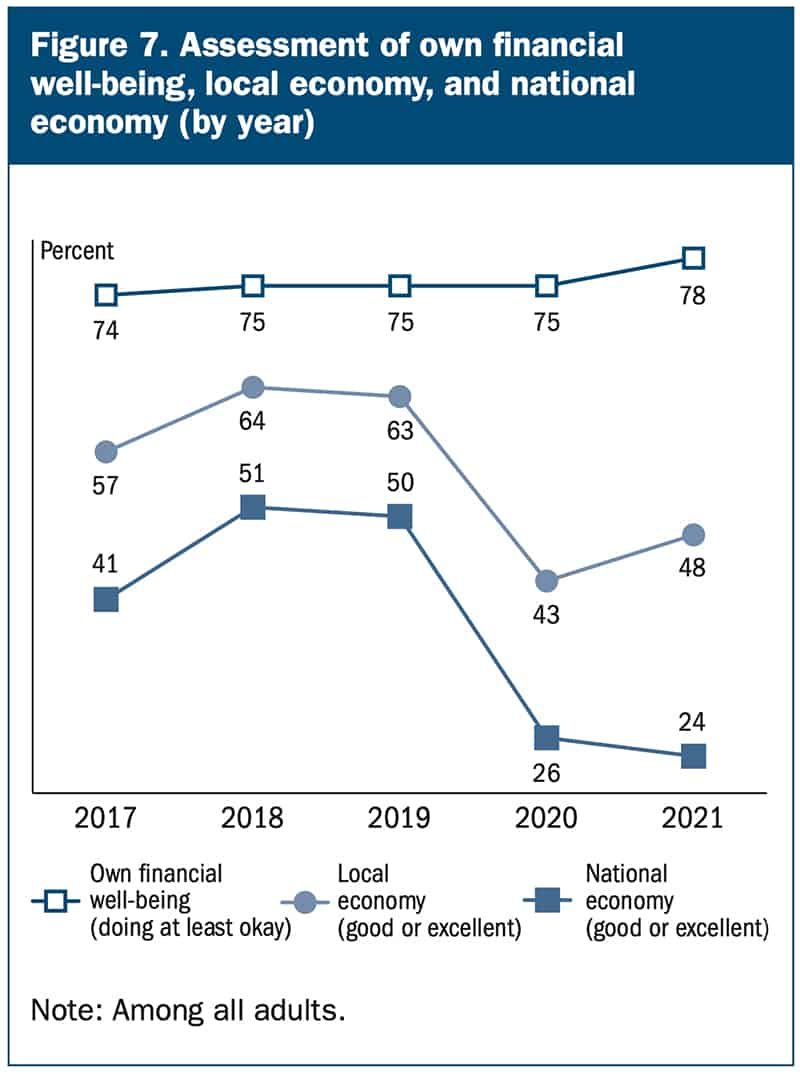

To me, nevertheless, probably the most attention-grabbing chart is that this one, which compares respondents’ assessments of their private well-being with their evaluation of native and nationwide economies. Take a look at this chart and inform me what you make of it. (I’ve an opinion, however I would like you to develop your personal speculation earlier than studying mine…)

From the report:

Just like individuals’s perceptions of their native financial system, the share score the nationwide financial system favorably fell precipitously from 2019 to 2020, after the onset of the pandemic ). Nonetheless, individuals’s perceptions of the nationwide financial system continued to say no in 2021. Solely 24 % of adults rated the nationwide financial system as ‘good’ or ‘glorious’ in 2021, down 2 proportion factors from 2020 and about half the speed seen in 2019. This development contrasts starkly with individuals’s more and more favorable evaluation of their very own monetary well-being.

The Fed report tells us this discrepancy exists but it surely does not inform us why it exists. Why do 78% of Individuals say that their very own monetary state of affairs is a minimum of okay, however practically the identical quantity imagine that the nationwide financial system is not doing effectively? I do not know. However I can consider two doable causes.

First, maybe most Individuals have realized to handle cash. Maybe they have been studying cash blogs and listening to cash podcasts, and now the teachings have sunk in. Perhaps they’ve begun saving and investing correctly over the previous fifteen years in order that their private financial system is now shielded from the gyrations of the financial system at massive.

Maybe.

I harbor a suspicion, nevertheless, that there is one thing else at play right here.

Lengthy-time readers know the way a lot I abhor the information media. The mass media doesn’t report actuality. Should you envision life as a bell curve (or “regular distribution”, when you favor), the mass media tends to report solely outlier occasions — particularly detrimental outlier occasions. The overwhelming majority of our lives comprise regular, optimistic, wholesome interactions and relationships and situations. The information does not report these.

On this case, I am unable to assist however wonder if this disparity between perceptions of private financial well-being and nationwide financial well-being are pushed (a minimum of partly) by detrimental financial information, information that highlights the issues with our financial system reasonably than the issues which might be going proper.

That is what I assume. What do you assume? What is the motive for this hole in notion?

Remaining Ideas

There’s rather more information and perception on this 92-page report. I’ve highlighted just some stats from the primary part on general monetary well-being. Different sections cowl revenue, employment, sudden bills, banking and credit score, housing, schooling, scholar loans, retirement and investments, and extra.

I discovered the part on scholar loans attention-grabbing too. It comprises numerous insights. Debtors with much less schooling, for instance, usually tend to be behind on mortgage funds. This makes some sense, I believe. In the meantime, fewer individuals are behind on funds than two years in the past (and this is applicable throughout all demographics).

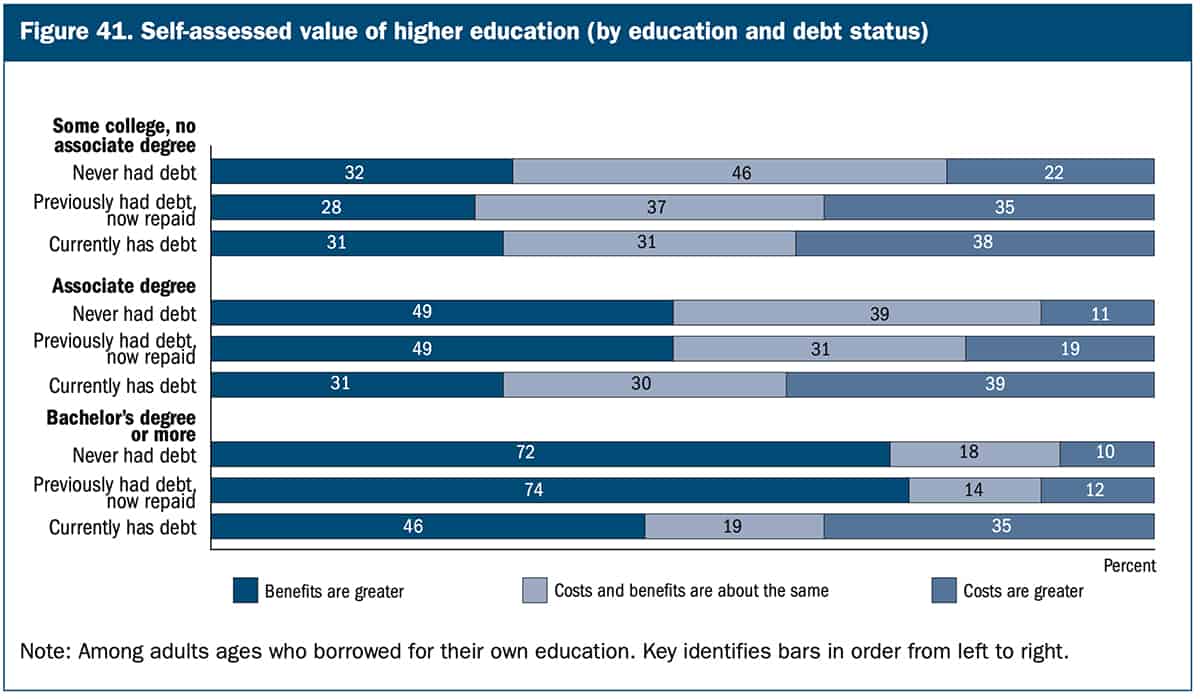

Right here, although, is my favourite chart from the whole report. It measures the self-assessed worth of upper schooling:

Two issues appear clear right here. First, of us who by no means needed to borrow for school imagine their schooling is price extra. Second, the extra schooling one obtains, the extra useful it appears.

Okay, a 3rd factor. Examine this chart with the one I shared earlier that highlights monetary well-being by degree of schooling. It is clear that (objectively) schooling does enhance monetary well being. However those that have scholar loans cannot at all times see that. Their subjective expertise appears to contradict the info. Attention-grabbing…

Anyhow, the Fed’s Financial Nicely-Being of U.S. Households in 2021 is stuffed with attention-grabbing information. It is price studying (or skimming) the following time you sit all the way down to waste time on the web!