Decentralized finance, or DeFi, has revolutionized enterprise and unlocked new worth throughout each trade sector. Nonetheless, important issues have emerged with blockchain know-how, hindering the unlocking of the complete potential of Internet 3. Vitalik Buterin, the Ethereum blockchain co-founder, has postulated a so-called “blockchain trilemma,” which means a blockchain is unable to ship decentralization, scalability, and safety on the identical time, so builders need to make trade-offs between them.

The DeFi increase is exposing Ethereum’s scalability points and skill to deal with elevated utilization resulting in community congestion and better fuel charges for processing transactions on the Community. Ethereum’s response to those points is the long-awaited Ethereum 2.0 (since 2014), which might make Ethereum concurrently extra scalable, safe, and sustainable whereas nonetheless remaining decentralized.

In the meantime, Solana is one other extremely useful open-source web-scale blockchain with a permissionless nature providing an bold design that goals to resolve the blockchain trilemma. Matt Hougan, chief funding officer at Bitwise Asset Administration, calls Solana a “main Ethereum competitor.”

So how do Solana and Ethereum differ? This assessment will current a Solana vs. Ethereum detailed comparability and dive deep into the important thing options, ecosystems, benefits, and downsides of the Ethereum Community and Solana.

Let’s get began!

Ethereum Execs

- The world’s most outstanding DApp and DeFi ecosystem

- Permits the event and deployment of good contracts

- Zero downtime

- Safe, decentralized, and environment friendly.

Ethereum Cons

- Requires substantial processing energy

- Sluggish transaction velocity

- Excessive fuel charges.

Solana Execs

- Low transaction charges

- No congestion, processing 50,000 transactions per second (TPS)

- Scalable protocol.

Solana Cons

- Lack of decentralization

- Protocol experiences sporadic halts.

Ethereum or Solana: Preliminary Information

Ethereum and Solana each present good contracts which might be essential in operating DApps and NFTs however with totally different transaction speeds. It’s important to know what unites Ethereum and Solana, in addition to the distinctive options of every blockchain, earlier than investing.

Ethereum Community

In 2013 Ethereum Community was created as the primary competitor to Bitcoin by a gaggle of builders, together with Vitalik Buterin, Gavin Wooden (Polkadot founder), and Charles Hoskinson (head of Cardano).

Ethereum modified the blockchain trade ceaselessly by changing into the primary good contract programmable blockchain.

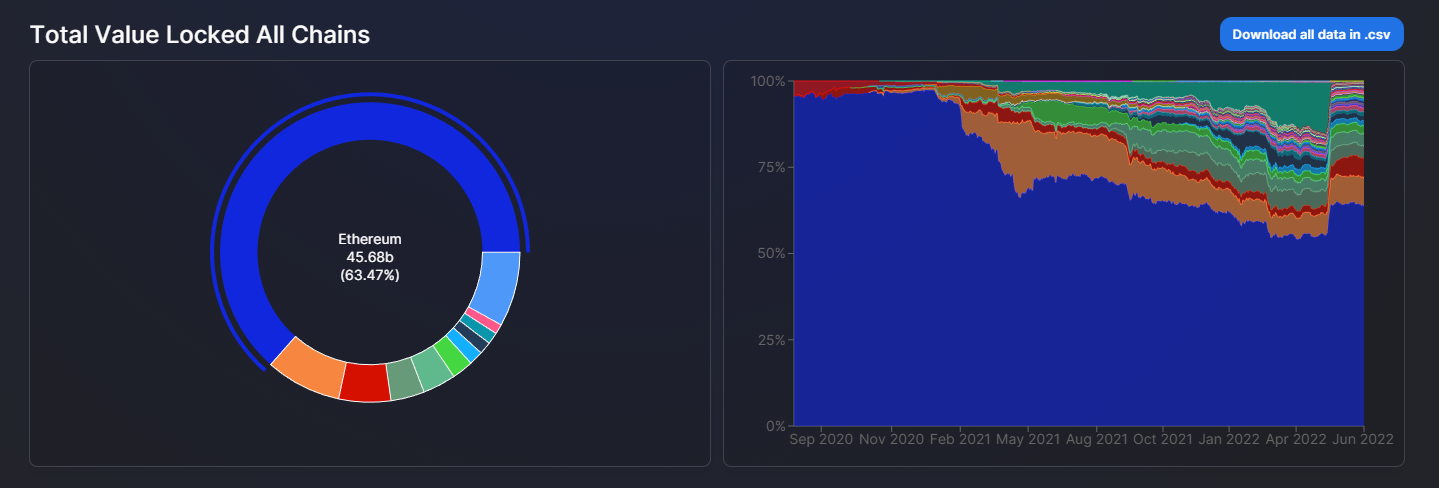

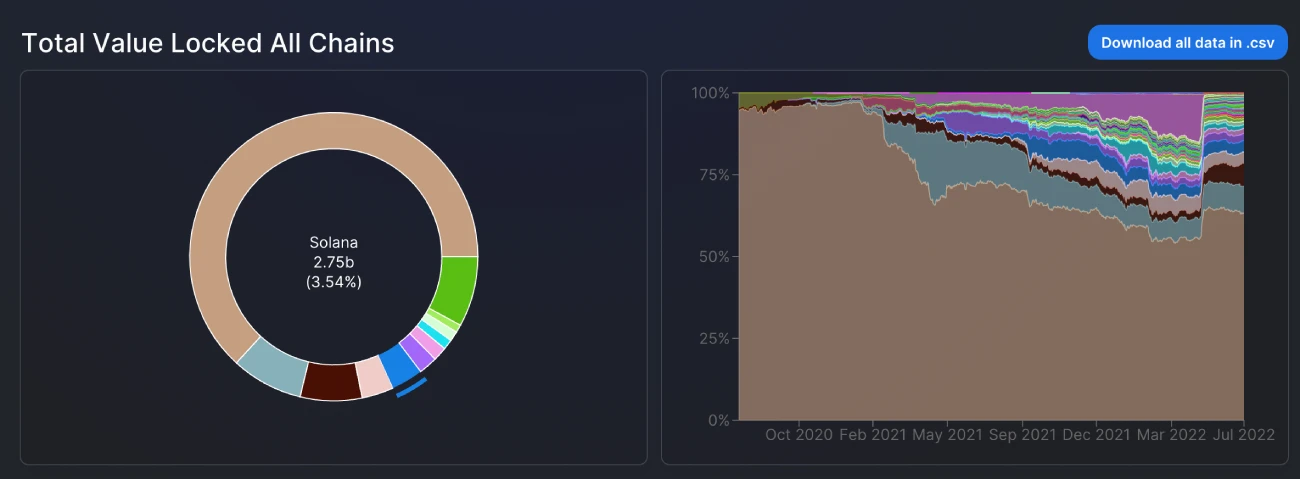

Ethereum’s token Ether (ETH) is at the moment the second-largest crypto available in the market in accordance with DeFi Llama. In the meantime, Ethereum, a blockchain that provides a clear and superior DApps ecosystem, dominates the DeFi market by a big margin, with a market cap of $49.1 billion, whereas Solana comes fifth with a market cap of $2.75 billion.

Because the frenzy round varied decentralized functions (DApps) and non-fungible tokens (NFTs) intensifies, the competitors between layer one protocols grows fiercer.

Ethereum is the primary blockchain to supply good contract performance and probably the most outstanding blockchain for Layer 2 venture growth; nonetheless, its Proof of Work (PoW) mining system and excessive fuel charges have confirmed to impede transaction velocity and scalability inside its DeFi ecosystem.

In 2021, a number of good contract-enabled Layer 1 blockchains have been created to handle these points by promising greater transaction speeds at decrease prices — one thing Ethereum lacks and goals to realize utilizing its Ethereum 2.0 improve. Solana is one such extremely useful open-source venture that implements a brand new, permissionless, and high-speed layer-1 blockchain aiming to ship excessive throughput and low prices.

Solana Community

Anatoly Yakovlenko based Solana in 2017. The Solana community implements an revolutionary hybrid consensus mannequin as an try to resolve the blockchain trilemma. It combines a singular Proof-of-Historical past (PoH) algorithm with a lightning-fast synchronization engine, a model of Proof-of-Stake (PoS) to course of over 710,000 transactions per second (TPS).

Solana facilitates good contracts and DApp creation and helps a variety of DeFi platforms and NFT marketplaces.

Solana’s native toke SOL offers a method of transferring worth and blockchain safety by staking. SOL was launched in March 2020 to turn out to be one of many high 10 cryptocurrencies within the crypto market by whole market capitalization.

Let’s tackle the core variations between Solana and Ethereum beneath.

The important thing distinction within the Solana vs. Ethereum comparability lies within the consensus mechanism, a compulsory process adopted by all blockchain nodes to succeed in agreements concerning the current state of the Community.

Ethereum’s Proof-of-Work Consensus Mechanism

Ethereum presently leverages the PoW consensus mechanism, drawing energy from a number of miners worldwide taking part actively within the consensus. PoW consensus calls for excessive computing energy, thereby proscribing the scope of participation for customers. It helps guarantee safety and full decentralization for ETH, nevertheless it additionally suffers from considerations of diminished efficiency.

By the tip of September 2022, the complete Community will transit to an alternate consensus mechanism – Proof-of-Stake (PoS). Ethereum is about to interchange the PoW, the environmentally unfriendly consensus mechanism it makes use of immediately, with the rather more eco-friendly PoS mechanism. PoS dramatically reduces vitality consumption by making mining out of date. As an alternative, PoS depends on a system of validators, or nodes, to confirm every transaction.

Solana’s Proof-of-Historical past Consensus Mechanism

The Solana Community makes use of a singular hybrid consensus mechanism that options the very best of Proof-of-Stake and Proof-of-Historical past. The hybrid consensus on the Solana blockchain allows higher flexibility for arranging the order of transactions enabling round 50,000 transactions per second.

The PoH is a system that allows transaction verification by time stamps. The PoH computational sequence creates a historic file proving that an occasion has occurred at a particular second in time. It incorporates a system for timestamping transactions to judge and ultimately produce a singular output that may be verified publicly. In consequence, validators all have a “uniform view of the order” by which new transactions seem on the blockchain. Community individuals analyze the validity of transactions and should agree on a single historical past of occasions – for this reason the system is named the Proof-of-Historical past (PoH) consensus.

The revolutionary mixture of PoS and PoH makes Solana a singular venture within the blockchain trade.

One other important criterion for Solana vs. Ethereum comparability is the blockchain structure.

Ethereum Community offers the true instance of stateful structure by recording all of the transactions on the Community within the current state. When a brand new transaction occurs, the complete Community should replace its copies of the transaction to replicate the current transaction. Naturally, the fixed replace takes time and vitality and is partially chargeable for the congestion plaguing Ethereum.

However, Solana has a stateless structure, without having to replace the entire state of the Solana blockchain with each new transaction. Solana’s structure depends closely on the Solana cluster, a set of validators working collectively to handle consumer transactions alongside ledger upkeep. Each cluster has its personal chief, and the position continues rotating among the many validators. The cluster chief is chargeable for bundling and timestamping the incoming transactions utilizing PoH consensus. Its stateless structure offers quick and low-cost transactions.

Solana additionally makes use of the Tower Byzantine fault tolerance (BFT) algorithm, an improvised model of pBFT (sensible Byzantine fault tolerance ) that removes the necessity for nodes to speak with one another in real-time, thereby bettering the general effectivity.

Sensible contracts performance is what initiated the complete DeFi trade. In brief, good contracts are pc applications, or transaction protocols, which intend to mechanically execute or doc a authorized occasion (corresponding to a cash transaction) in accordance with the phrases of the contract.

Ethereum Community was the primary to introduce good contract performance to the blockchain know-how, whereas the remainder of the Layer 1 platforms, together with Solana, applied the system on their blockchains.

The Solana community, nonetheless, affords a sensible contract performance that differs from different tasks, by which good contracts could intrude with each other since they’ll’t function in parallel.

Solana makes use of Sealevel, a system that permits good contracts to run aspect by aspect with out inflicting any disruptions. This offers Solana a major benefit when it comes to efficiency ranges within the Community.

Scalability

The core distinction between Solana and Ethereum refers to scalability. Scalability is the property of a system to deal with a rising quantity of labor by adjusting its effectivity or including assets.

Concerning Ethereum, scalability is the primary concern the Community has to take care of. Regardless of the excessive fuel charges, the variety of DApps on the blockchain multiplies, requiring increasingly more validation and a better transaction velocity.

The transaction velocity on Ethereum is just 15 transactions per second, so the scalability downside can solely be resolved by the event of Layer 2 scaling options and help for multi-chain networks, from state channels to sidechains, i.e., Validium and Rollups (Optimistic). Ethereum additionally helps multi-chain networks, corresponding to Polygon, that assist improve its scalability with out compromising safety.

However, Solana addresses the scalability concern with a high-performance protocol that provides revolutionary time structure, improved transaction processing speeds, and an environment friendly consensus mannequin. Which means Solana doesn’t require Layer 2 options to boost scalability. Furthermore, Solana achieves scalability by using the Turbine block propagation protocol that breaks down knowledge into smaller fragments to switch it throughout the Community simply.

Ecosystem

The Ethereum and Solana ecosystems are incomparable in measurement.

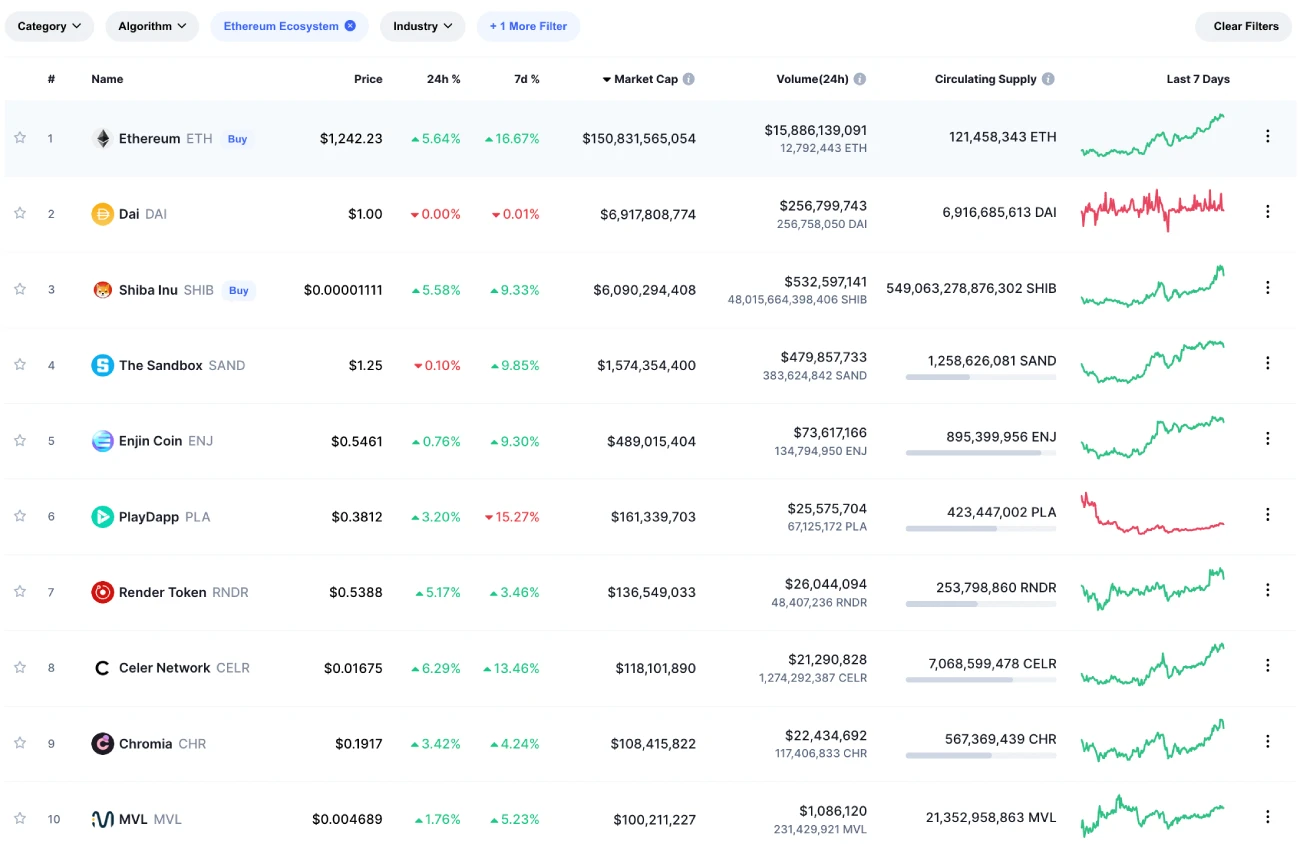

Ethereum encompasses a numerous household of DApps, from decentralized exchanges to NFT marketplaces, stablecoins, lending, and gaming protocols.

A few of the most profitable protocols operating on Ethereum embrace Tether stablecoin, SushiSwap decentralized change, Opensea, the most important NFT market, and so on. Furthermore, Ethereum helps a wealthy suite of tokens.

Right here’s a listing of the highest 10 tokens by market cap operating on the Ethereum Community.

The checklist contains a number of main tokens, corresponding to USD Coin stablecoin, Shiba Inu meme coin, and Polygon.

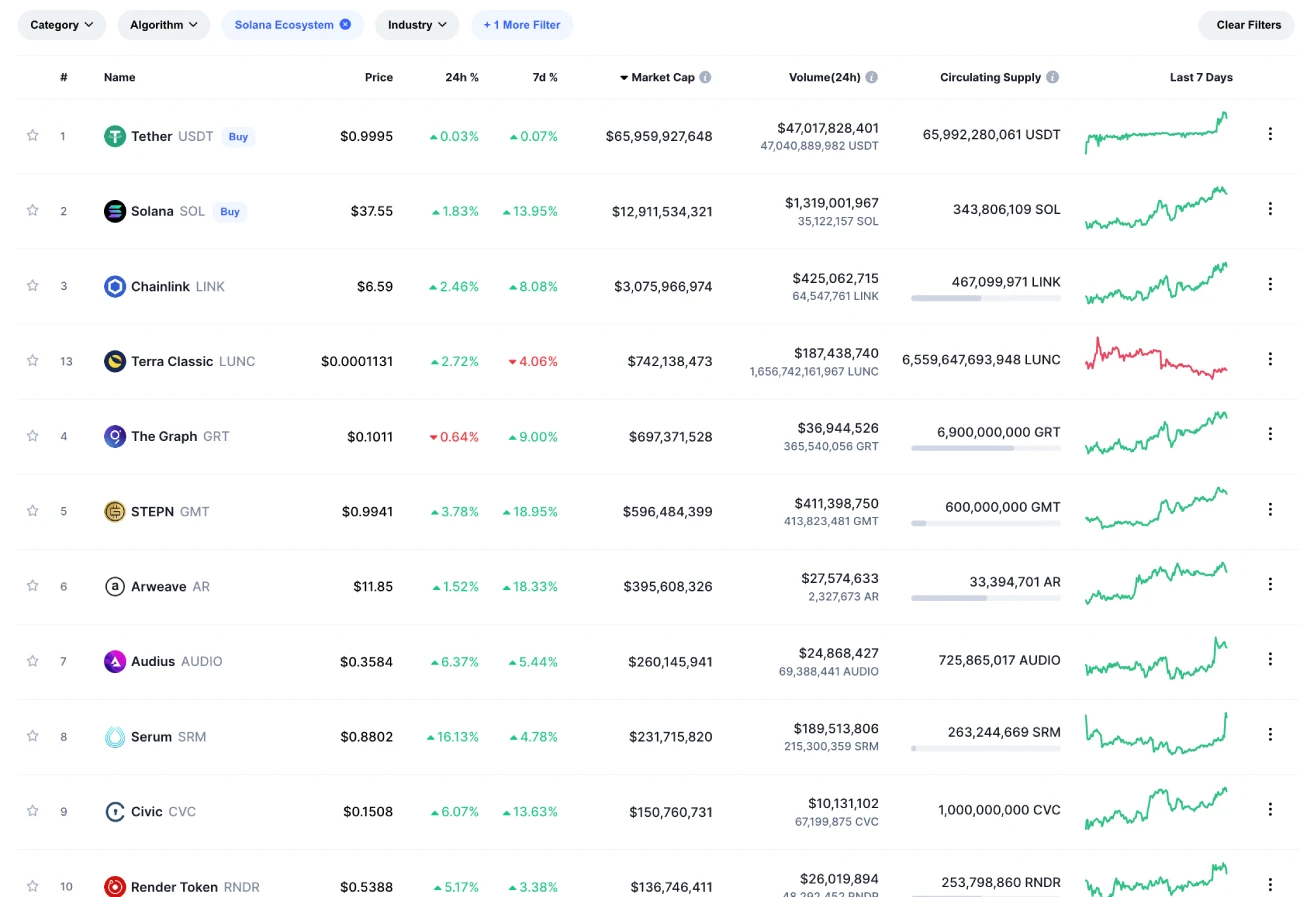

Whereas Solana is a younger platform in comparison with Ethereum, it nonetheless encompasses a appreciable quantity of tokens, decentralized exchanges, lending/borrowing protocols, NFT marketplaces, and so on.

Here’s a complete checklist of the highest 10 tokens operating on the Solana blockchain:

The checklist contains the main cryptocurrency Chainlink (LINK) and the move-to-earn platform STEPN’s token GMT.

NFT Buying and selling

NFTs or non-fungible tokens have turn out to be a necessary a part of the DeFi trade.

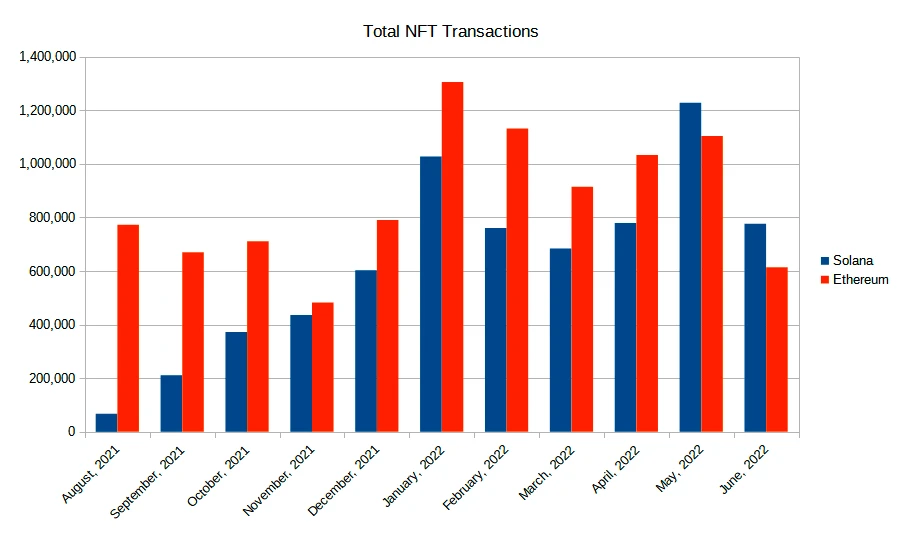

The biggest NFT-trading platform, Opensea, initially began off on Ethereum; nonetheless, {the marketplace} lately introduced a partnership with Solana as properly. In consequence, Solana’s NFT commerce boomed, competing in volumes with Ethereum.

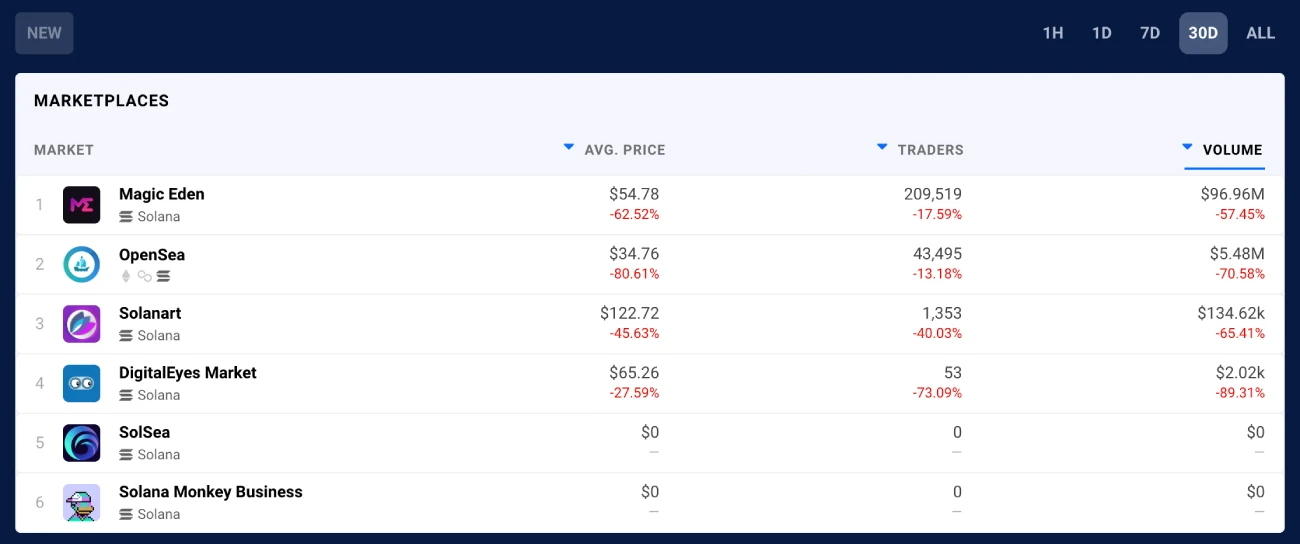

Moreover, Solana’s native market Magic Eden considerably contributed to the success. In response to DappRadar, Magic Eden has witnessed appreciable progress since early April.

In consequence, Solana’s month-to-month NFT transactions have surpassed Ethereum’s over the previous couple of months.

What Makes Ethereum Community Distinctive

As talked about earlier, Ethereum was the inspiration for the complete DeFi trade, together with the booming NFT market. With a major first-mover benefit, it’s no shock that Ethereum Networks is at the moment the most important platform within the crypto market.

As of June 2022, Ethereum hosts practically 3,000 decentralized functions (DApps) on the blockchain, with extra being created month-to-month. Ethereum’s reputation might be defined by its top-notch safety, reliability, and fame. Nonetheless, the congestion and excessive fuel charges are among the many drawbacks of the Ethereum Community.

Ethereum continually searches for options to realize quicker transaction speeds and enhanced scalability and has launched a number of Layer 2 protocols to assist with the problems.

What Makes Solana Distinctive

Solana has positioned itself as an answer to all Ethereum issues, corresponding to scalability, excessive fuel charges, and low transaction velocity.

Solana can attain a velocity of over 50,000 TPS, and Solana’s distinctive consensus algorithm makes it one of many quickest blockchains within the trade. One other benefit is Solana’s excessive cost-effectiveness, because the venture implements new tokenomics for decrease charges. Solana’s blockchain can be extra eco-friendly and sustainable than Ethereum.

Nonetheless, the Solana ecosystem is not any match for Ethereum when it comes to DApp safety and decentralization.

To sum up, Solana is of explicit curiosity to builders and customers who’re fed up with the excessive fuel charges and gradual growth tempo of the Ethereum community.

Solana vs. Ethereum: Remaining Verdict

We now have extensively mentioned each platforms concerning transaction velocity, fuel charges, scalability, ecosystem, consensus mechanisms, and so on. Let’s sum the outcomes up:

- Ethereum has a bigger and extra dependable ecosystem, whereas the Solana ecosystem is significantly smaller in measurement.

- Solana is very scalable and affords one of many quickest and best ecosystems, whereas the Ethereum Community is plagued with congestion.

- Solana makes use of an revolutionary Proof-of-Historical past system powered by distinctive algorithms. Ethereum employs the PoW consensus mechanisms to confirm transactions.

- Solana affords low-cost transactions, whereas Ethereum options notoriously excessive fuel charges.

- Solana makes use of a fraction of the vitality assets wanted to energy the Ethereum digital machine. Ethereum has but to transition to the greener Ethereum 2.0.

- Ethereum has skilled hacks prior to now however is taken into account safer than Solana.

- Ethereum 2.0 was promised for years and is lastly scheduled for September 2022. Nonetheless, Solana builders transfer significantly quicker.

- Ethereum boasts greater decentralization than Solana. Each networks have had disagreeable incidents prior to now, however total, because of the nonetheless legitimate PoW consensus, Ethereum wins the decentralization race.

Conclusion

If you happen to’re nonetheless questioning which of the 2 tasks is a greater funding and whether or not it’s best to make investments, the reply continues to be as much as you. We hope the analysis into the benefits and demerits of every blockchain venture will provide help to make an knowledgeable funding determination.

So, whether or not you select Ethereum or Solana will rely in your wants and priorities. Ethereum is extra respected and safe however slower, energy-consuming, and dearer. Solana is considerably quicker, low-cost, and sustainable however smaller and extra centralized. Prioritize correctly and keep in mind that this information shouldn’t be monetary recommendation. Every dealer ought to do their very own analysis earlier than investing within the unstable crypto market.

Ceaselessly Requested Questions

Ethereum and Solana share similarities; nonetheless, they differ when it comes to ecosystem measurement, transaction velocity, transaction charges, decentralization, consensus mechanism, and so on.

Ethereum affords a extra mature DeFi infrastructure powered by numerous builders. Solana, alternatively, is a a lot youthful platform, nevertheless it offers quicker and cheaper transactions with out congestion issues. Which is best relies on your particular wants and expectations.

As of June 2022, Solana can course of over 50,000 transactions per second (TPS), whereas Ethereum’s TPS stands at roughly 13. Ethereum is progressing to Ethereum 2.0, and as soon as the improve is full, it should course of over 100,000 TPS.

Ethereum takes up over 60% of the DeFi market, whereas Solana’s share is merely 3.6%. Nonetheless, Solana is a current venture in fixed growth and has a devoted group because of its excessive transaction velocity.