One morning simply over ten years in the past, I had an fascinating dialog on the Crossfit gymnasium. I used to be “rolling out” — utilizing a foam curler to interrupt up tissue — with the same old group of men, when one in every of my buddies introduced up this new factor known as Bitcoin.

“Bitcoin is digital cash,” he stated. “Nevertheless it’s utterly personal and never tied to a authorities.”

“How does that work?” I requested. From the very first second I heard about cryptocurrency, it did not appear to make any sense. My buddy tried to clarify. All of us chatted about it for a couple of minutes, after which we lifted heavy weights and/or sweated extensively and/or each of the above.

After I obtained dwelling, I googled Bitcoin. Nothing I learn made any sense to me. I checked the worth. My reminiscence is that Bitcoin was promoting for $7 or $8 on the time.

Over the previous decade, I have been bombarded with information about Bitcoin and cryptocurrency. I’ve made an effort to self-educate, to be taught why individuals think about crypto helpful and why they suppose it is the way forward for cash. To this present day, I nonetheless have not discovered an explainer that has really defined issues effectively sufficient for me to actually perceive.

This 21-minute video from Slidebean has been simplest at serving to me grasp the fundamentals of the blockchain and cryptocurrency, but it surely nonetheless did not persuade me that these items was helpful.

Regardless of all of this, I’ve discovered myself step by step being worn down over time. So many individuals endorse cryptocurrency, together with individuals who appear to be savvy and good. Kim’s brother, for example, is a large advocate of cryptocurrency. He and his spouse have netted tens of hundreds of {dollars} by dabbling in cryptocurrency. (They purchased a brand new SUV with income from one transaction.)

So, final fall, I succumbed to the mania.

Doubling Down on Dumb

After promoting our dwelling and shopping for a brand new one final 12 months, I had a big chunk of change sitting in my checking account. I deliberate to place this cash into index funds ultimately, however was retaining it in money whereas we had been settling into our new dwelling. I used the cash to purchase furnishings and to restore the roof and so forth.

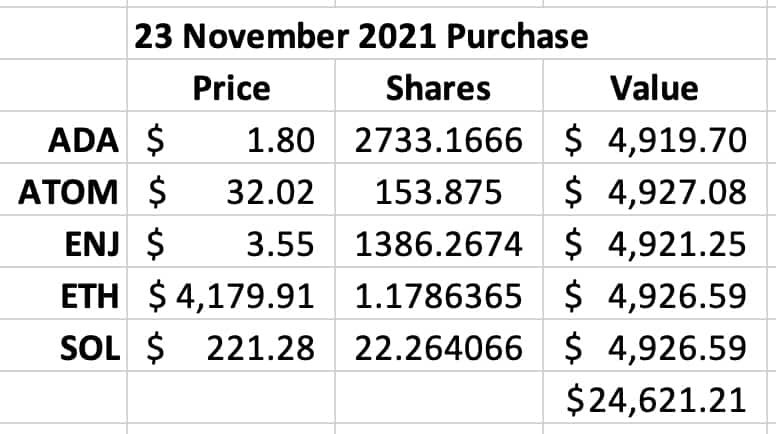

On November twenty third of final 12 months, I made a decision to conduct just a little experiment. The easiest way for me to study cryptocurrency, I made a decision, was to have some pores and skin within the sport, to truly purchase some. So I did. I put $5000 every into 5 completely different “cash” — a $25,000 funding. I purchased Ehtereum (ETH), Cosmos (ATOM), Enjin (ENJ), Cardano (ADA), and Solana (SOL). Do not ask me why I selected these specific cash. I had causes on the time, however I can now not keep in mind them.

Listed here are my transactions.

Astute readers will probably be asking, “Should you purchased $5000 chunks of every coin, then why did you could have solely about $4925 in every after the acquisition.” I am going to inform you why: as a result of transaction charges within the crypto world are outrageous. I used Coinbase as my “pockets” and buying and selling platform, and so they took an enormous chunk out of each transaction. This itself must be a crimson flag. (Or, at the very least, a yellow flag.)

After transferring this cash into crypto, I started to really feel uneasy. This was partially because of the declining crypto market. You are all the time going to really feel uneasy whenever you’re dropping cash, proper? However a much bigger drawback was that I knew I might achieved one thing silly.

Considered one of my cardinal guidelines of investing (for myself) is to not spend money on one thing that I do not perceive. I realized this rule from the writings of billionaire Warren Buffett (one in every of my private monetary heroes), who applies this to his personal funding choices. Buffett has famously missed the boat on some huge corporations — Google and Amazon, for example — as a result of he did not perceive how their companies labored, so he did not make investments. He is okay with that. He’d reasonably miss some winners than get sucked into losers. I like that philosophy, and I often use it to information my choices. Normally.

This time, nevertheless, I watched as my cryptocurrency declined in worth.

I used to be torn. A part of me needed to promote, to get out from beneath the psychological weight of this “funding”. However one other a part of me hated the concept. “I purchased excessive,” I instructed myself. “I should not promote low.”

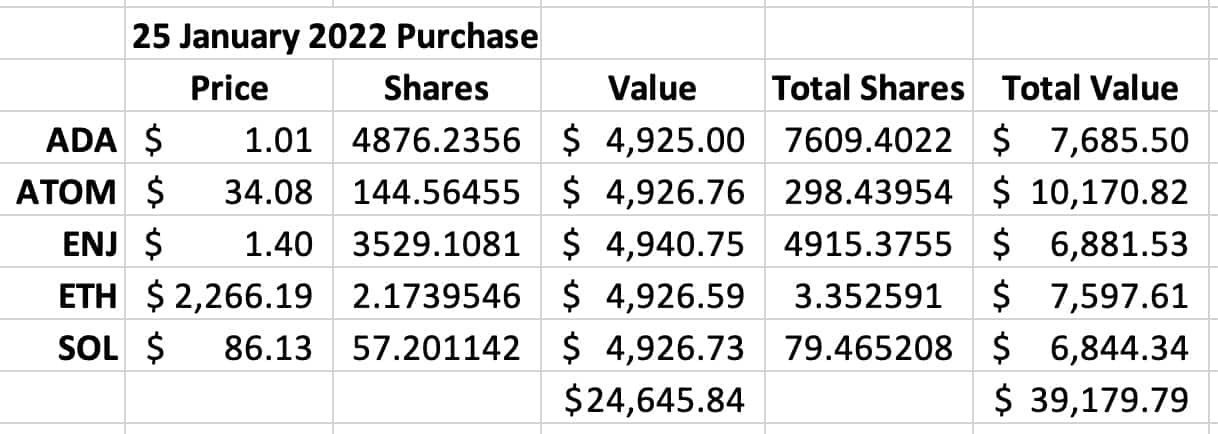

By January, my $25,000 in cryptocurrency had declined in worth to someplace round $15,000. I did not need to promote at a $10,000 loss. So, I doubled down on dumb. On January twenty fourth — after a giant dip within the crypto market — I put one other $5000 every into these identical 5 cash. (I rationalized this as dollar-cost averaging.)

That is proper: Over the course of two months, I “invested” $50,000 into one thing I did not perceive and did not imagine in, one thing that I essentially considered as a pyramid scheme. There isn’t any want to inform me how silly I’m. I already know.

An Escape Hatch

February and March had been excruciating. Crypto costs remained largely flat, however with a common downward development. I used to be apprehensive {that a} huge crash would come and wipe out all of my cash. Then, concerning the time my cousin Duane’s well being started to worsen on the finish of March, costs climbed for every week or two. I noticed a chance. I offered all the pieces.

Ultimately, I moved $47,750.49 again into my checking account on March thirty first. That is not the $50,000 I began with, however shut sufficient. (And word once more how I offered $48,409.91 however solely netted $47,750,49. As soon as once more, I misplaced a ton to transaction charges. This looks like a rip-off inside a rip-off.)

I imagine that my crypto story is typical of most (though maybe with bigger quantities of cash). I wasn’t investing. I used to be speculating. I noticed individuals I do know making tens of hundreds of {dollars} on this new expertise, and I needed in on the motion. So, regardless of not understanding how this all labored, I put cash into the crypto market. I used to be playing.

Looking back, I obtained fortunate. Sure, I misplaced $2249.51 in 4 months, however that is far lower than I may need misplaced.

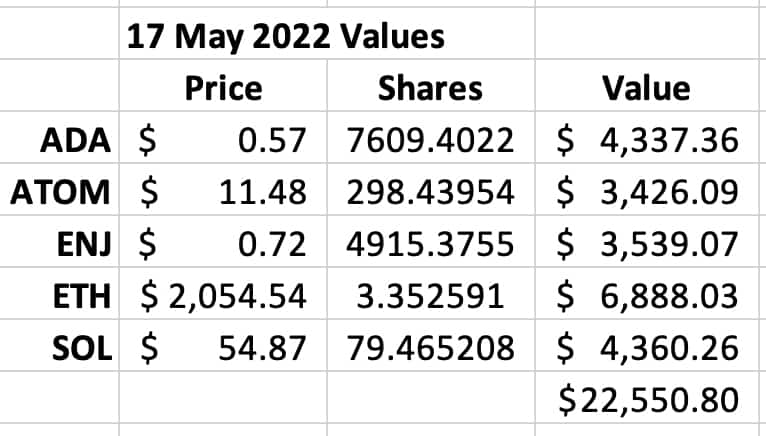

What if I had been so caught up with caring for Duane that I paid no consideration to my cryptocurrency? What if as a substitute of promoting on the finish of March, I offered at this time? Nice query. Let’s take a look at what my portfolio worth can be as of this very second (about 08:00 on 17 Could 2022):

If I had not offered, the worth of my cash can be lower than half what they had been six weeks in the past.

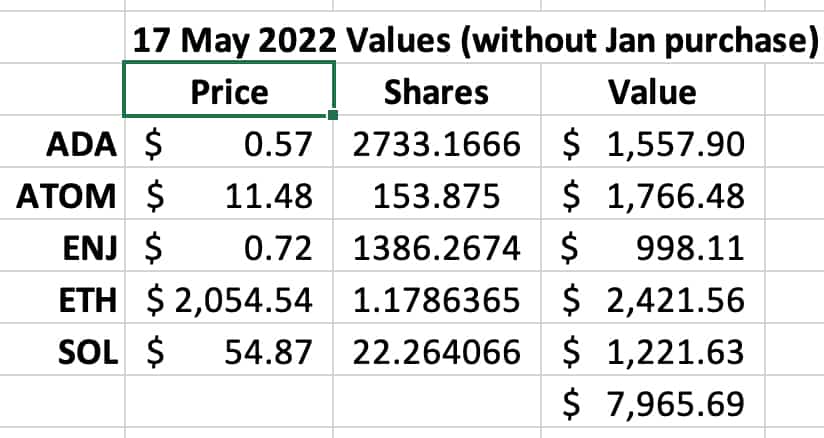

And take a look at this! Here is what the worth of my crypto portfolio can be at this time if I hadn’t made the January buy and the March sale. Here is what my unique $25,000 “funding” can be price if I might merely purchased and held.

That is a 68% drop. Holy cats!

Investing in What I Know

Now, I perceive utterly that I am not taking a protracted view right here. I am “day buying and selling”, because it had been. That is one thing I’d advise towards within the inventory market, and I am positive there are individuals who advise towards it on the earth of crypto. For these people, it is a lengthy sport. And possibly they’re proper. Possibly costs will soar once more. Actually, they most likely will in some unspecified time in the future. However the extra I study cryptocurrency, the much less I perceive, and the extra I am grateful I obtained out after I did.

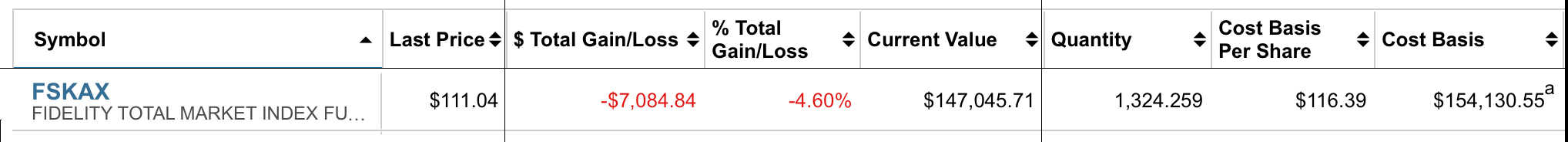

If that is the wave of the longer term, nice. I am glad some people will make some huge cash on it. I am not going to be a type of people. After an ill-advised mis-adventure, I’ve returned to investing in what I do know. On April twenty seventh, I moved most of my remaining money from the home sale ($154,130.55) into a complete market index fund (which, coincidentally, has additionally misplaced worth haha).

However this is the factor. Paper losses within the inventory market do not hassle me. I perceive how the inventory market works. I acknowledge that the inventory market permits me to buy tiny items of massive companies, companies with precise storefronts and factories and datacenters, companies with prospects and gross sales and revenues. I’ve confidence that proudly owning a broad-based index fund will enable me to share the long-term progress (and short-term losses) of the world’s enterprise group as a complete. This is sensible to me.

However crypto? I nonetheless do not perceive it. And the extra I study it, the extra it looks as if a large pyramid scheme. After a short foray into the world of crypto, I’ve determined to present it a cross. I am going to sit this one out.

However wait! What if I might bought Bitcoin 10+ years in the past after I first heard about it? What if I might, say, bought 100 “cash” at $8 every, made an $800 funding? Nicely, this morning Bitcoin is buying and selling at about $30,000 per coin. If I had 100 cash, they’d be price $3,000,000. That is some huge cash!

However this what-if state of affairs assumes that I’d have held these hundred cash from the time I first heard about them till at this time. The chances of that having occurred are nearly zero. If I had bought 100 cash at $8 every, I’d have offered them lengthy, way back. I’d have offered them earlier than they reached $800. Or $80. I most likely would have offered them as soon as they reached $18.

Additional Studying

You should not actually take cryptocurrency recommendation from me as a result of, as I’ve talked about a number of instances, I do not perceive how the hell it really works or why it has worth. It is senseless to me. It is best to make your personal choices concerning crypto based mostly on the recommendation of individuals smarter than I’m.

A kind of good individuals is Nicholas Weaver, a senior employees researcher on the Worldwide Laptop Science Institute and a a lecturer on the UC Berkeley pc science division. Here is a protracted and fascinating interview with Weaver from Present Affairs through which he says that all cryptocurrency ought to die in a hearth. One quote:

So the inventory market and the bond market are a positive-sum sport. There are extra winners than losers. Cryptocurrency begins with zero-sum. So it begins with a world the place there will be no extra profitable than dropping. Now we have methods like this. It’s known as the horse observe. It’s known as the on line casino. Cryptocurrency investing is actually provably playing in an financial sense. After which there’s designs the place these energy payments need to receives a commission someplace. So as a substitute of zero-sum, it turns into deeply negative-sum.

Successfully, then, the financial analogies are playing and a Ponzi scheme. As a result of the income which are given to the early traders are actually taken from the later traders. This is the reason I name the area total, a “self-assembled” Ponzi scheme. There’s been no intent to make a Ponzi scheme. However as a consequence of its nature, that’s the solely factor it may be.

And here’s a current episode of This American Life through which host Ira Glass explores the world of cryptocurrency and NFTs (non-fungible tokens).

Lastly, from The New York Instances (and therefor presumably behind a paywall for you) is the latecomer’s information to crypto, which does its greatest to be an even-handed overview of the world of cryptocurrency.

If you know of articles or podcasts or YouTube movies that do job of explaining cryptocurrency, please go away them within the feedback in order that I can add them to this record. Listed here are a number of of the items that GRS readers have really useful:

Let me know if there are extra items I ought to add right here…