How a lot try to be saving for school on your little one? It is one of many greatest questions we get requested nearly on a regular basis. How a lot ought to we’ve got in a 529 plan? How a lot ought to we save for school? How a lot do we have to fear about this? And the reply is hard – it relies upon.

The thought of a 529 Faculty Financial savings Plan is nice: you’ll be able to contribute cash into an account and it’ll develop tax free to sometime pay on your kid’s training. And you may contribute some huge cash too (as much as $300,000 in most states). That is not the place the difficulty arises.

The true hassle comes from rising tuition prices and the way a lot each “school financial savings calculator” says you have to save on your kid’s training. Based on The Faculty Board, the common value of a public 4-year school in 2020-2021 was $10,740 for in-state tuition. The common value for a personal school was $38,070.

Whenever you begin plugging these numbers into the faculty financial savings calculator, all of a sudden you are supposed to start out saving over $500 monthly on your little one. Then, add that into your personal financial savings for retirement, and you are not going to have something left for your self every month!

So let’s dive in and see how a lot you must have in a 529 plan.

Observe The Order Of Operations For Saving For Faculty

That single quantity provides me sticker shock every month after I take into consideration saving for my kid’s school training. However it’s additionally an essential reminder of why everybody ought to comply with the Order of Operations For Saving For Your Child’s Faculty.

The important thing phrase is Y.E.S.:

(Y) YOU: You must make sure that your personal monetary home is so as earlier than you attempt to save on your kid’s school. If you cannot make lease, or purchase groceries, there are larger points to repair first. Nonetheless, the YOU bucket additionally consists of saving on your personal retirement and ensuring you have got an emergency fund. I’ve stated this a whole bunch of instances – you’ll be able to’t get a mortgage for retirement. Ensure you save for your self first.

(E) Training Financial savings Accounts: In the event you’ve saved for your self, subsequent it can save you on your little one in Training Financial savings Accounts, just like the 529 Plan.

(S) Financial savings: After contributing some quantity to the 529 plan or different training financial savings account, it is good to avoid wasting in a standard financial savings account as properly, in case there are different bills you need to assist your little one with that do not qualify as training bills.

How A lot You Actually Want To Save In A 529 Plan

Half 2 of that “scary” quantity that you have to save every month on your kid’s school is that quantity is predicated on saving 100% of their school prices. As a mother or father, you needn’t pay for 100% of their college. Or, perhaps you may pay for 100% of their public in-state tuition, and the remainder is as much as them. Or perhaps you may simply have a goal financial savings quantity, and the remainder is as much as them.

It is merely essential to do not forget that you do not have to avoid wasting and pay for all their school. It is THEIR school – not yours. Plus, there are tons of how for them to seek out assist paying for varsity, from discovering scholarships, to getting scholar loans.

Here is our information on how you can pay for school.

So, as a substitute of stressing out about saving $500 monthly, I will make the next assumptions and save primarily based on that:

- I will save for an in-state school that at present prices $10,200 per yr

- I’ll contribute to all 4 years of school

- I’ll pay 50% of the projected school prices

- I am executed contributing to the 529 plan when my little one is eighteen (sorry, however you are out of the home now!)

- I anticipate school prices to proceed to extend by 4% per yr

- I anticipate to get 6% per yr return on my investments in my 529 plan

With these assumptions, try to be saving about $96 monthly on your kid’s school, or $1,151 per yr. Let’s have a look at how that breaks down.

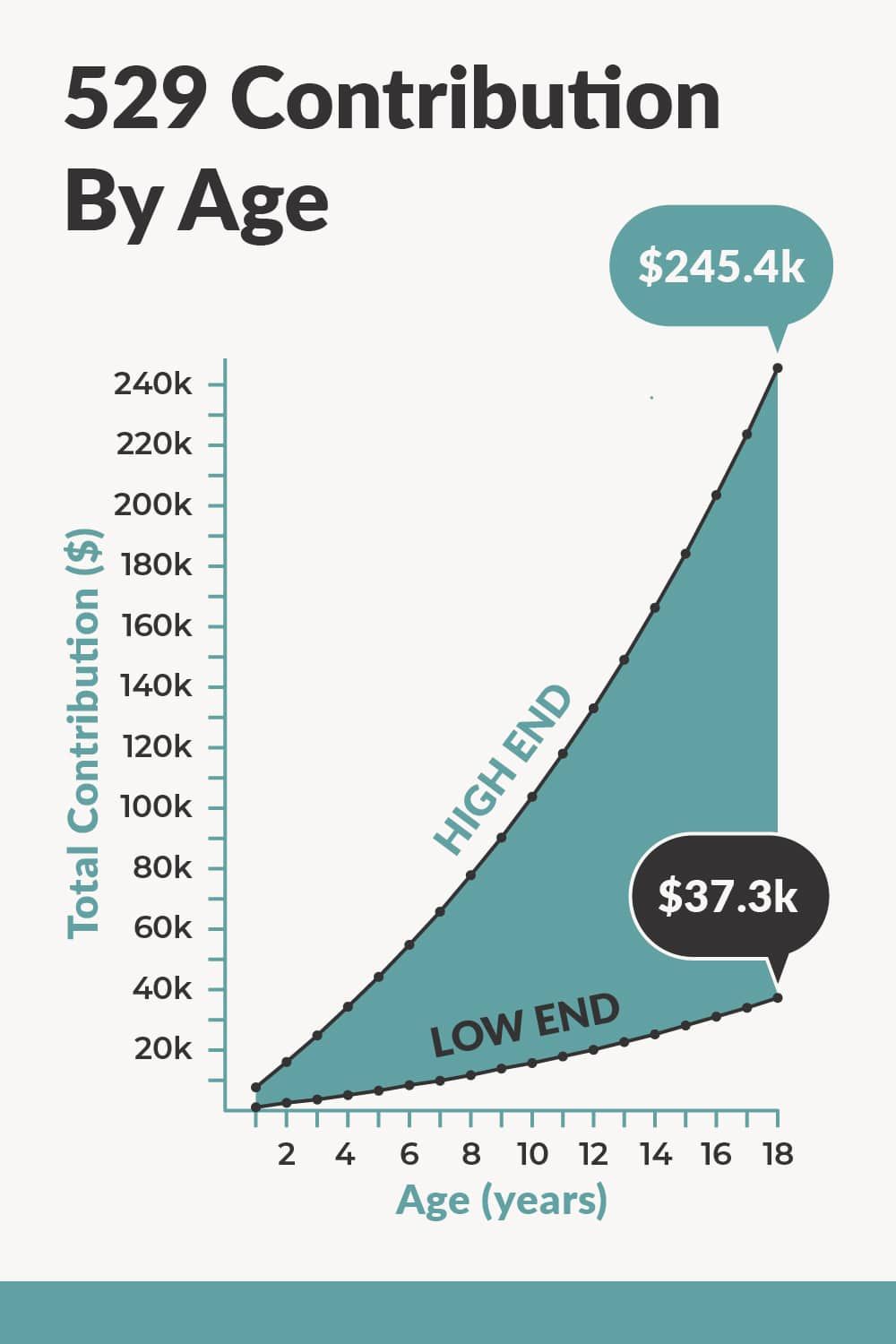

Nonetheless, should you’re on the excessive finish, and need to contribute to pay 100% of your kid’s training bills at a 4 yr non-public school, I included that within the chart beneath too (for reference it means contributing $630 monthly).

If you’d like higher estimates, take a look at our 529 Plan Information By State, discover your state, and see what the prices to go to varsity are in your particular state.

How A lot You Ought to Have In Your 529 At Completely different Ages

Constancy additionally has a fantastic free calculator that permits you to decide how a lot your want particularly on your scenario. They leverage most of the identical assumptions we do above, and agree that you just needn’t save 100% of your kid’s school training bills. Try tinheritor school financial savings calculator right here.

You may additionally discover this 529 plan contribution restrict information useful.

529 Faculty Financial savings Plan Tips

From the outcomes, we are able to conclude that the purpose for most individuals saving for school needs to be to have between $37,328 and $245,427 saved within the account. It is a enormous vary, little question. However bear in mind what “low finish” and “excessive finish” imply.

The low finish quantity is for somebody that wishes to assist their little one pay for a public 4-year college. The excessive finish quantity is for somebody that wishes to completely pay for a 4-year non-public training for his or her little one.

Mother and father must also do not forget that, even when saving for personal college, many college students who attend non-public colleges get discounted tuition, or obtain scholarships to offset the “actual” tuition worth. So, even that top finish quantity won’t make sense when saving for school.

On this state of affairs, the low finish 529 plan will be capable to pay out between $9,600 and $10,000 per yr, for every of the 4 years of faculty. On condition that the faculty prices will rise, that needs to be about 50% of a 4-year public college tuition in 18 years.

The place To Open A 529 Plan

What many individuals do not understand is that you would be able to spend money on nearly any state 529 plan. For some folks, it may make sense to make use of your personal state’s plan to benefit from the tax deduction – however not all states provide tax deductions on contributions (notably California).

If the state does not matter, the following issues to take a look at are efficiency and ease of saving. For efficiency, you need good efficiency for low charges. For ease of financial savings, we take a look at whether or not the plan could be related to financial savings packages like Backer.

Try this information right here, discover your state, and see what plan we suggest: 529 Plan Information.

SavingForCollege.com ranks one of the best plans yearly. What plan you select relies on the state you are in. Try the map beneath and discover your state:

Suggestions To Assist Save For Faculty

Even saving simply $100 monthly can look like daunting process. I do know it’s for me. Nonetheless, in terms of saving for school, listed here are some easy tips that may assist:

1. Save your entire kid’s birthday and vacation cash. In lots of households, youngsters obtain cash from their grandparents, aunts, uncles, and extra. I’d estimate that the common child receives at the least $200 per yr in present cash. In the event you saved that, you are 20% of the best way to fulfilling their annual 529 contribution.

An effective way to do that is to make use of a service like Backer. Backer makes 529 plan gifting really easy – so you’ll be able to each save on your kids or assist a buddy or member of the family save as properly.

2. Have a look at Upromise. It is a free service that’s designed to assist households pay for school by merely doing their regular buying. Upromise affords money again rewards for linking a credit score or debit card and utilizing that card at taking part retailers. You possibly can earn wherever from 1% to 25% again at totally different retailers. Upromise says that some members are incomes at the least $1,000 per yr – that is nearly all the things you have to totally fund a 529 plan. Plus, proper now you may get a $25 bonus should you hyperlink your 529 plan inside 30 days of signing up! UPromise is straightforward to enroll and save for school – test it out right here.

3. Deal with incomes more cash. As a substitute of taking a look at the place to chop in your finances, ask your self, how are you going to add $100 in earnings to your finances? I am a agency believer that anybody can earn an extra $100 monthly, and what a greater option to put that additional $100 to make use of than by funding a 529 plan on your little one? If you do not know the place to start out, take a look at our listing of over 50 methods to earn extra cash on the aspect.