Entrance-loading of economic support like grants and scholarships is a type of bait-and-switch, the place a university provides a greater monetary support provide to freshmen than to sophomores, juniors and seniors.

When a university practices front-loading of economic support, the typical grant per recipient decreases after the primary yr and/or the share of scholars receiving grants decreases.

This implies college students get smaller grants and/or fewer college students get grants. Even when a university retains the grants unchanged, the online worth will enhance as school prices enhance.

Entrance-loading of grants causes the combination of grants vs. loans to turn into much less favorable after the freshman yr. The household’s share of faculty prices will increase considerably for upperclassmen, even when their means to pay for school stays unchanged.

Statistics Regarding Entrance-Loading of Grants

Greater than four-fifths of schools apply front-loading of grants, primarily based on an evaluation of information from the 2021 Built-in Postsecondary Training Knowledge System (IPEDS). IPEDS information is offered by the universities and is printed by the Nationwide Middle for Training Statistics (NCES) on the U.S. Division of Training.

IPEDS information supplies two units of statistics, one for full-time first-time undergraduate college students (i.e., freshmen) and one for all undergraduate college students. These statistics embody:

- The variety of college students awarded federal, state, native, institutional or different sources of grant support

- The overall quantity of federal, state, native, institutional or different sources of grant support awarded

- The overall variety of college students

One can subtract the figures for full-time first-time undergraduate college students from the figures for all undergraduate college students to calculate the figures for upperclassmen.

The ratio of the variety of college students awarded grants to the entire variety of college students yields the share of scholars receiving grants.

The ratio of the entire quantity of grants to the variety of college students awarded grants yields the typical grant per recipient.

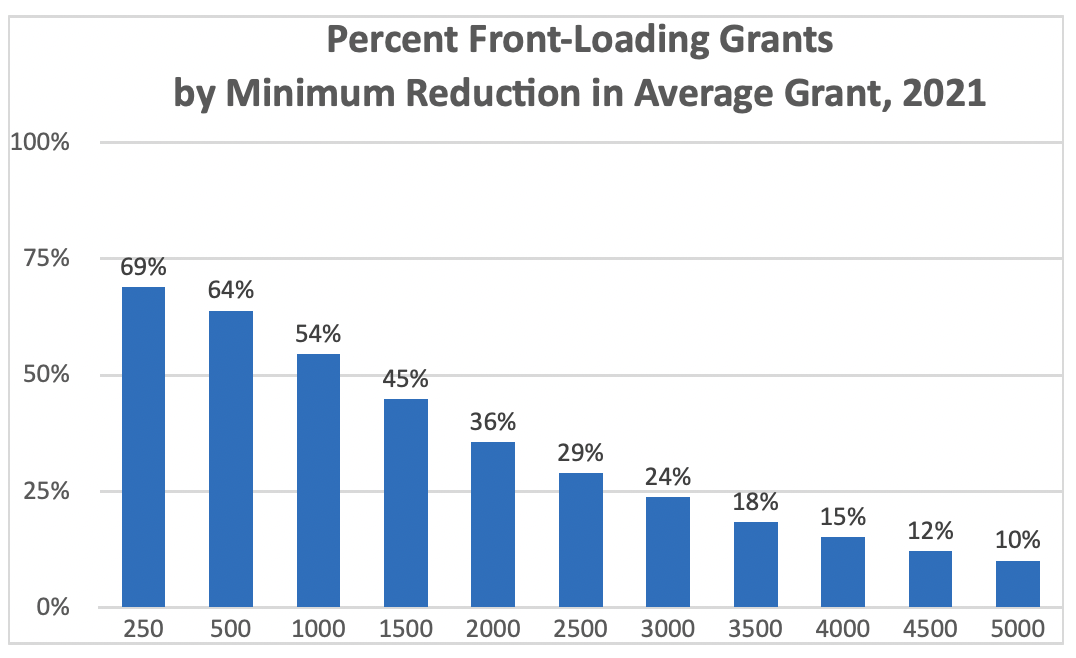

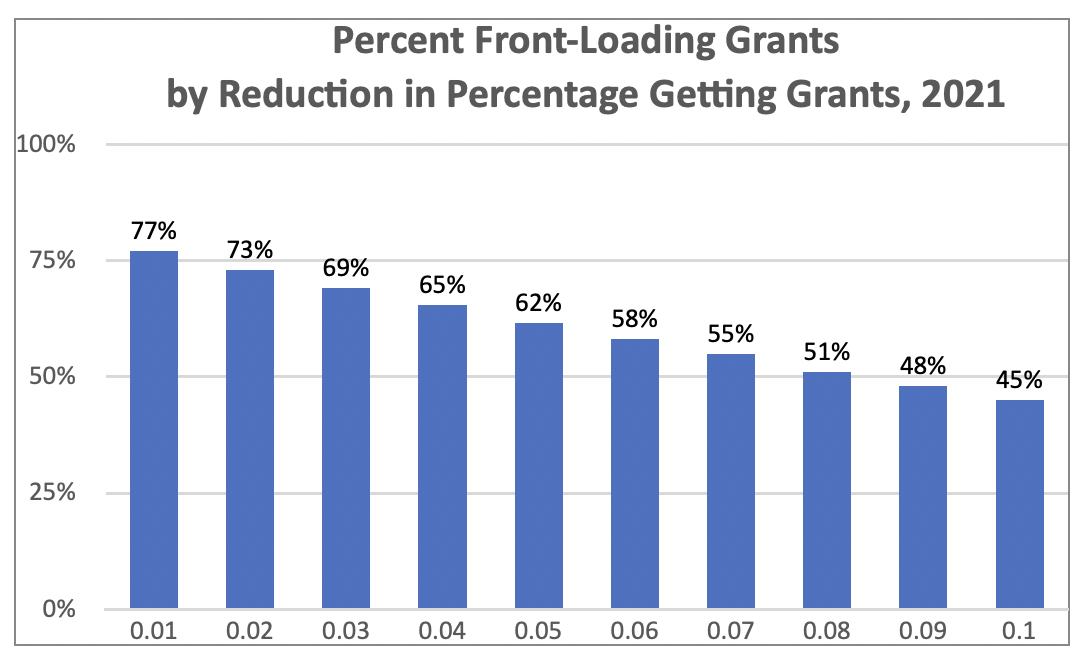

Greater than half (54%) of 4-year faculties scale back the typical grant by not less than $1,000. Greater than three-fifths (62%) of 4-year faculties scale back the share receiving grants of not less than 5% share factors. Greater than four-fifths (82%) of 4-year faculties fulfill both or each of those definitions.

Public faculties usually tend to apply front-loading of grants. Amongst public 4-year faculties, 88% fulfill both or each of those thresholds. Amongst personal non-profit 4-year faculties, 80%. Amongst personal for-profit 4-year faculties, 75%.

Essentially the most selective faculties are much less seemingly than much less selective faculties to apply front-loading of grants, though it’s nonetheless a excessive share. Amongst 4-year faculties that admit lower than 40% of candidates, 70% fulfill both or each of those thresholds. Amongst 4-year faculties that admit greater than 40% of candidates, 83% fulfill both or each of those thresholds.

This chart reveals the share of 4-year faculties lowering common grants by not less than every particular greenback quantity.

This chart reveals the share of 4-year faculties lowering the share of scholars receiving grants by not less than a particular share level.

MIT, Swarthmore, Amherst, Bowdoin, Tulane, Harvey Mudd, UCLA, Georgetown, USC, Carnegie Mellon College, UC Berkeley, College of Michigan at Ann Arbor and UNC Chapel Hill don’t apply front-loading of grants. For instance, at MIT there is no such thing as a change within the share receiving grants, and the typical grant will increase by about $2,000 for upperclassmen.

Among the many Ivy League faculties, solely Princeton and Cornell don’t apply front-loading of grants. The others all apply front-loading of grants.

One Ivy League establishment, who shall stay unnamed, has a 16% share level discount within the share of scholars receiving grants, and the typical grant decreases by about $12,500 for upperclassmen. This identical school has one of many lowest commencement charges among the many Ivy League faculties.

The way to Inform If a Faculty Practices Entrance-Loading of Grants

You’ll be able to’t use a university’s web worth calculator to find out whether or not a university practices front-loading of grants, since web worth calculators are restricted to only the freshman yr in school.

As a substitute, you should utilize the U.S. Division of Training’s Faculty Navigator instrument to find out whether or not a university practices front-loading of grants.

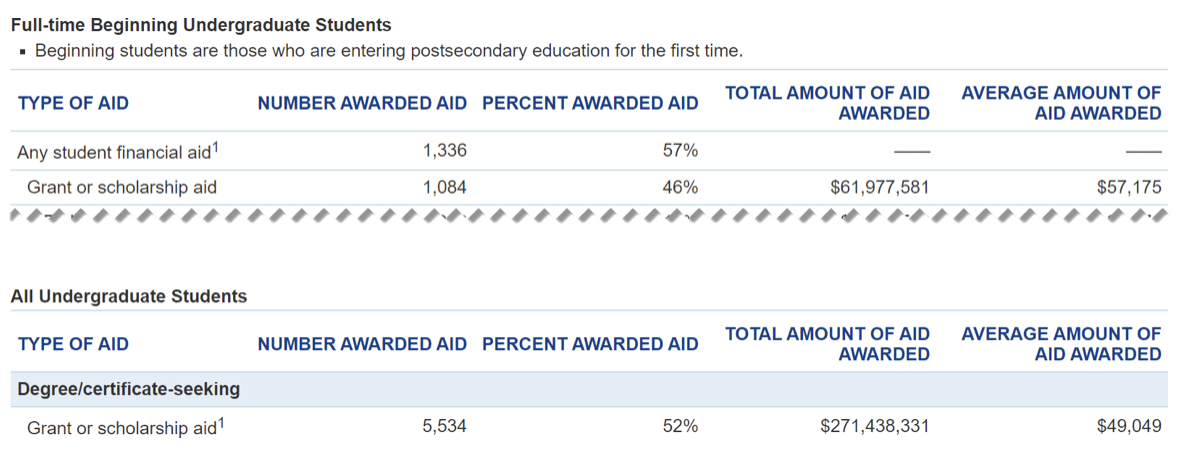

Seek for the title of the school, then click on on the Monetary Support tab within the search outcomes. There can be two units of numbers, labeled Full-time Starting Undergraduate College students and All Undergraduate College students. Take a look at the P.c Awarded Support and Common Quantity of Support Awarded columns for the Grant or scholarship support rows. A bit arithmetic will yield the typical grant for upperclassmen for comparability with the determine for freshmen.

For instance, take into account a university with the next figures proven in Faculty Navigator. Subtract the Complete Quantity of Support Awarded and Quantity Awarded Support for Full-Time Starting Undergraduate College students from All Undergraduate College students, yielding $209,460,750 and 4,450. Divide the latter into the previous, yielding an Common Quantity of Support Awarded of $47,070 for upperclassmen. That’s greater than $10,000 decrease than the typical grant support for freshmen. This school clearly practices front-loading of grants.

Word that you simply don’t have to do the maths to inform that the typical grant awarded to freshmen is larger than the typical grant awarded to all undergraduate college students. It’s much less exact than calculating the figures for upperclassmen, nevertheless it nonetheless reveals that the school practices front-loading of grants.

Impression of Entrance-Loading on Outcomes

Entrance-loading of grants might have an preliminary constructive impression on school enrollment, for the reason that grants make school appear to be extra reasonably priced. Entrance-loading of grants helps faculties recruit extra college students.

However, school retention might fall because of elevated prices after the primary yr. The elevated prices will disrupt the coed’s educational progress, as they’re compelled to search out different methods to cowl the school prices. They might, for instance, must work longer hours to earn extra money to pay for school. However, college students who work a full-time job are half as more likely to graduate inside six years as in contrast with college students who work 12 hours or much less per week.

They might additionally must borrow extra, rising scholar mortgage debt at commencement.

The rise within the web worth could have a destructive impression on school commencement charges. Extra college students will drop out after they can’t afford to pay the school payments or when working longer hours takes an excessive amount of time away from lecturers.

Entrance-loading of grants has a destructive impression on switch college students, who obtain much less support than college students who began as freshmen.

Faculties Can’t Justify Entrance-Loading of Grants

Entrance-loading of grants can’t be defined by modifications in household monetary circumstances. Though some college students might qualify for much less monetary support due to elevated household earnings, most college students expertise flat household earnings. Total, modifications in household earnings don’t clarify the lower in common grants, nor do they clarify the shift from grants to loans.

Likewise, front-loading of grants can’t be defined by non-renewable scholarships, as the online impression is comparatively small, particularly when one considers the impression of scholarship displacement. Additionally, unmet want exceeds $10,000 on common nationwide.

Some faculties argue {that a} very excessive share of their enrollment comes from switch college students, and they’re much less beneficiant to switch college students. Which may be true, however that’s hardly one thing to be happy with. Solely 4% of 4-year faculties have greater than 1 / 4 of their undergraduate enrollment from switch college students.

Editor: Colin Graves

Reviewed by: Robert Farrington

The put up Entrance-Loading Monetary Support: Watch Out For This Sneaky Trick appeared first on The Faculty Investor.