Cryptocurrency staking is a central idea within the crypto world.

Cryptocurrency buyers worldwide benefit from the revenue created via cryptocurrency buying and selling or mining. You’ve in all probability heard of the success tales of crypto buyers making tens of millions of {dollars} by investing early and promoting when the crypto-assets’ costs are excessive.

Nonetheless, making a revenue from cryptocurrency fluctuations could be difficult and requires particular data, time, and abilities. Likewise, crypto mining requires technical experience and important upfront funding in specialised {hardware}.

Should you’re making an attempt to determine the way to become profitable from the cryptocurrency markets with out investing heaps of time and money, you would possibly take into account staking on decentralized finance (DeFi) networks. Many DeFi protocols provide nice incentives for individuals who stake crypto and lock them into good contracts by offering curiosity on funding and governance tokens.

At its most elementary, staking cryptocurrency permits you to become profitable on cryptocurrency saved in your crypto pockets. It’s the method of investing cash into digital cash and accumulating curiosity and charges from blockchain transactions.

Cryptocurrency staking includes locking up your funds in your private cryptocurrency pockets for a particular interval to contribute to the efficiency and security of the blockchain community and earn rewards within the type of extra cash or tokens.

This text will clarify every thing it is advisable learn about staking Ethereum for incomes ETH staking rewards. We’ll additionally discover Ethereum’s improve to Ethereum 2.0 by switching from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism and supply a fast tutorial on the way to stake Ethereum.

So, with out additional ado, let’s get began!

What Is Staking

Staking is a well-liked strategy to generate further revenue along with your cryptocurrencies for those who plan to carry them for a particular interval. Most main cryptocurrency exchanges present platforms for staking cryptocurrency, permitting you to earn passive revenue for holding cryptocurrency on the change.

Staking solely applies to blockchains that make the most of the Proof-of-Stake (PoS) consensus mechanism, through which staking is used to validate transactions. In a PoS consensus, a participant node is allotted the duty to keep up the general public ledger. On a Proof-of-Stake blockchain, the best to confirm transactions is assigned to customers randomly, based mostly on the variety of tokens they’ve staked. So, holders of a required variety of cash can earn staking rewards and take part in validation, i.e., confirm transactions as wanted. As you’ll be able to see, you’ll be able to stake cash to earn curiosity as a substitute of buying and selling them.

Customers staking property in a PoS blockchain for an agreed-upon interval to earn rewards in return are referred to as validators. PoS validators present worth to the community and are chosen based mostly on the upper variety of staked cash.

A Proof-of-Stake blockchain is much less power-consuming and, due to this fact, solves scalability points confronted by a Proof-of-Work blockchain, through which miners need to compete to resolve complicated mathematical issues to confirm and course of transactions and add them as a brand new block within the blockchain. The PoW mechanism of verifying transactions on the blockchain is powerful and safe but additionally very time-consuming and requires a whole lot of energy consumption. This hinders the variety of transactions that may be processed by a blockchain concurrently and due to this fact causes a scalability situation.

Ethereum is switching from a Proof-of-Work to a Proof-of-Stake consensus mechanism, referred to as Ethereum 2.0 (ETH 2.0), aiming to enhance the Ethereum community’s scalability and safety. The complete improve will likely be accomplished by 2023.

To be taught extra about staking and the way it’s totally different from yield farming, go to “What Is Staking.”

What Is Ethereum 2.0

The Ethereum blockchain is a general-purpose blockchain, performing as the inspiration for hundreds of functions, blockchain networks, tokens, and so forth. What makes Ethereum progressive is its capacity to assist good contracts, the spine over which decentralized apps are constructed. The Ethereum blockchain allows builders to create ERC-20 tokens and incorporate them into their very own protocols. Furthermore, many of the altcoins, NFTs, and so forth., are constructed on the Ethereum community and are ERC-20 and ERC-721 tokens, respectively.

Whereas these options of the Ethereum blockchain have paved the best way for the mass adoption of cryptocurrencies throughout the globe, its recognition additionally means the Ethereum community has reached sure capability limitations. In consequence, transaction prices on the community, generally often called the fuel charges, have sky-rocketed, thereby making it tough for non-finance decentralized apps to function on the Ethereum blockchain. These limitations have created the necessity for “scaling options,” aiming to extend transaction pace (quicker finality) and transaction throughput (excessive transactions per second) with out sacrificing decentralization or safety.

The long-awaited Ethereum 2.0 is a response to those issues. The concepts behind the improve are to make Ethereum concurrently extra scalable, safe, and sustainable – whereas remaining decentralized. The improve is called The Merge, the place Ethereum will swap from a Proof-of-Work to a Proof-of-Stake mechanism. In consequence, the community’s capacity of processing transactions would attain as much as 100,000 transactions over a second, in distinction to the 15 transactions per second of the Ethereum community. The improve may even considerably scale back the fuel charges on the Ethereum 2.0 community.

How Does Ethereum Staking Work

The Beacon Chain is the brand new consensus mechanism of Ethereum 2.0. Validators, also called stakers, are accountable for processing transactions, storing knowledge, and including blocks to the Beacon Chain. As a reward for his or her staking, they earn curiosity on their staked ETH.

The requirement for changing into a validator is a staking minimal of 32 ETH tokens. Validators are required to provide new blocks and ensure any new blocks not made by them. If a validator fails to validate a block assigned to them by going offline or partaking in collusion or different mischievous actions, they’ll lose a big portion or the whole lot of their stake. This brings an enhanced stage of safety to the community and protects common customers from points that come up because of community or validator failure.

In Ethereum’s blockchain, below the PoS mechanism, 32 blocks of transactions are bundled throughout every spherical of validation, which lasts on common 6.4 minutes. Every such bundle is named an Epoch, and as soon as two extra Epochs are added after it, an Epoch is taken into account irreversible or finalized.

Ethereum’s blockchain is split into shards, and the Beacon Chain divides a validator node or stakers right into a “Committee” of 128 and assigns them to a particular shard block. Every committee is allotted a ‘slot’ to suggest a brand new block and validate the within transactions. Every epoch has 32 slots, requiring 32 units of committees to finish the validation course of. From the 128 validators, a validator node is randomly assigned to suggest a brand new block, whereas the remaining 127 members vote and validate transactions. The brand new block is added to the blockchain, and a “cross-link” is fashioned to authenticate its insertion as soon as a majority of the committee has attested it. The validator chosen randomly to suggest the brand new block will get the native block rewards. A block is finalized on the blockchain solely when two-thirds of the validators agree, and if validators attempt to reverse this later with a 51% assault, they’ll lose all their staked ETH.

Why Stake Ethereum

Now that you realize what staking is and the way staking works let’s look into the explanations try to be staking Ethereum:

- Earn Staking Rewards: Staking Ethereum requires a minimal of 32 Ethereum tokens, and the APR (annual proportion price) for staking ETH is anyplace between 6 to fifteen %. When you stake Ethereum tokens, you’ll be able to earn rewards between 2 and 5 ETH at present costs for at least 32 tokens. And the extra Ether tokens you stake, the extra ETH you’ll be able to earn as a reward. Begin by checking the Ethereum Worth.

- Stronger Safety: Should you’re a blockchain fanatic eager to contribute to offering stronger safety to customers, begin your Ethereum staking asap. The bigger the quantity of staked Ethereum on the community, the stronger safety the community will present. To turn out to be a risk, attackers would wish to manage the vast majority of Ethereum tokens within the system.

- Setting Pleasant: Staking Ethereum or another cryptocurrencies is extra eco-friendly and fewer energy-consuming than mining. It’s necessary as a result of the power consumption for Bitcoin mining has turn out to be an actual situation. With ETH 2.0, we’re transferring in direction of an environmentally sustainable blockchain.

Easy methods to Stake Ethereum

Now that you realize why try to be staking ETH let’s proceed to an in depth information in your staking choices for staking Ethereum and be taught the place and the way to stake Ethereum.

1. Solo Staking

Solo Staking is one of the best ways to stake Ethereum. In solo staking, you run an Ethereum node by your self on the web; due to this fact, the rewards you earn for staking ETH belong fully to you. Nonetheless, there are a number of limitations in solo staking Ethereum; for instance, you want a minimal of 32 ETH to stake Ether, which is an unlimited sum of money. One other downside is you should be related to the web always, because the Ethereum community penalizes nodes that go offline. Final however not least, to solo stake Ethereum, you need to have technical know-how about it, one thing that most individuals lack. Should you’re all for staking Ethereum by your self, you are able to do so at ethereum.org.

2. Staking Providers

A number of service suppliers can run a validator node in your behalf and take away the necessity for being related to the web always and having technical know-how. They supply staking ETH as a service, and all it’s a must to do is deposit your 32 ETH tokens to begin incomes staking rewards. These companies cost a small price on a month-to-month foundation for staking Ethereum in your behalf. Furthermore, your staked ETH will not be below your management, so it requires a sure stage of belief within the service supplier. Gemini, a good change, affords staking companies at an inexpensive price.

3. Staking Swimming pools

A staking pool is the preferred staking mannequin permitting customers to take part in numerous staking platforms and earn rewards. A staking pool is just a liquid staking resolution the place you don’t want 32 ETH for staking ETH. Staking swimming pools gather a small quantity of ETH or different staked property from totally different customers to run the node. The protocol rewards are distributed amongst the customers which have staked their crypto property in proportion to how a lot ETH or different property are staked. The liquid staking platforms cost a small price. A staking pool is without doubt one of the most viable options for customers that don’t wish to stake 32 ETH however are into incomes rewards via Ethereum staking. Lido and Rocket Pool are two of the preferred liquid staking protocols for securely staking your Ethereum.

4. DeFi Staking

Whereas many staking swimming pools that present staking companies are centralized and take management over your staked Ethereum, decentralized staking protocols comparable to Yield.finance mean you can stake Ethereum in a decentralized method. The good thing about decentralized staking is that it provides you extra management over your staked ETH. These platforms additionally provide stETH tokens that can be utilized within the DeFi ecosystem for actions comparable to getting a mortgage, incomes yield, trade-staked ETH tokens, and so forth.

5. Staking Ethereum on Crypto Exchanges

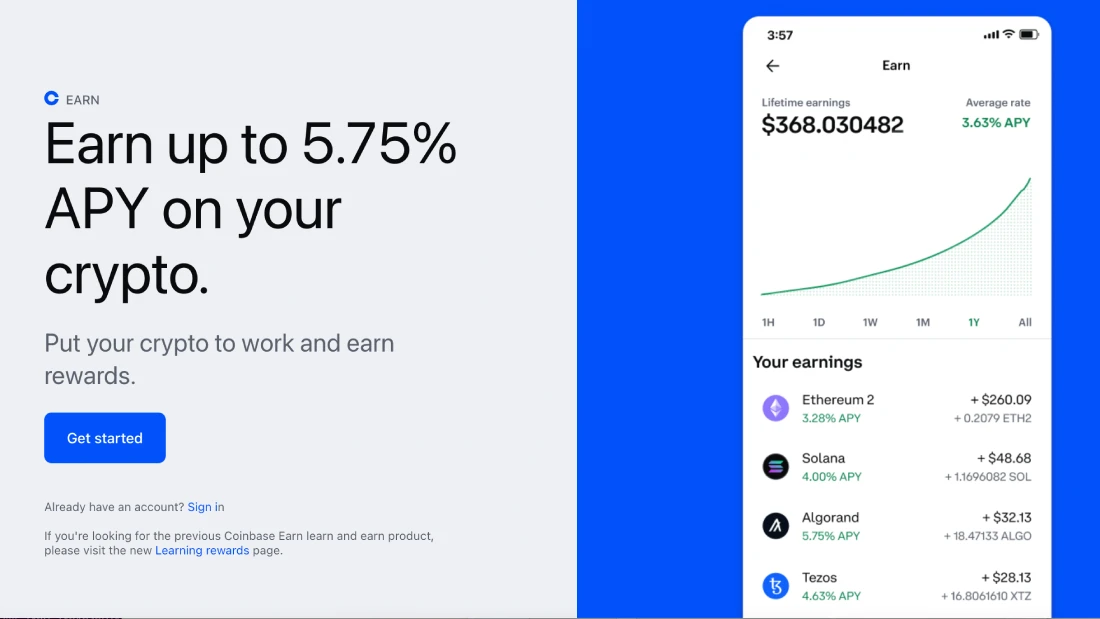

A number of crypto exchanges provide Ethereum staking companies to their customers. We’ll take the Coinbase change for example for staking Ethereum tokens on an change platform. To start out staking Ethereum on Coinbase, comply with the steps highlighted under:

- Create a Coinbase Account:

Step one is making a Coinbase account via the web site or the Coinbase cell app. You could enter a legitimate e-mail deal with and full your KYC verification to make use of Coinbase. - Purchase Ethereum:

If you have already got Ethereum tokens in different cryptocurrency wallets, you need to ship them to your Coinbase pockets. In any other case, you want an Ethereum pockets with Ethereum tokens to begin staking. You can too purchase Ethereum tokens straight on Coinbase. To discover ways to purchase Ethereum (Ether) tokens, test the CoinStats information “Easy methods to Purchase Ethereum.” - Stake Ethereum:

After getting ample Ether tokens in your pockets, you’ll be able to stake ETH simply after assembly the necessities talked about on the Coinbase web site. Whereas there isn’t a minimal quantity of Ether tokens required to stake ETH on Coinbase, there’s a most staking restrict that retains altering over time. Do not forget that for those who stake ETH on the Coinbase crypto change, it’ll preserve your ETH locked. Crypto buyers can view their staked Ether tokens as ETH 2.0 steadiness below lifetime rewards, however they received’t have the ability to withdraw the staked cash till the Ethereum 2.0 (ETH 2.0) Merge is accomplished.

Additionally Verify: Easy methods to Stake on Coinbase

Dangers Related With Ethereum Staking

Like with most issues related to the blockchain trade, there are some inherent dangers related to ETH staking. Among the mostly confronted dangers of Ethereum staking are:

- Lack of Management Over Funds:

This can be a frequent danger related to ETH staking or any type of staking on the whole. When you’ve determined to get your ETH staked, you’ll quickly lose management over your property. Keep in mind to test if the protocol offering excessive APY is reliable, as staking in dangerous protocols will put your ETH in danger and would possibly lead to shedding all of your deposit. - Lack of Regulatory Mechanisms:

No regulatory frameworks are in place for cryptocurrencies. So, whereas staking Ethereum, if the federal government decides to freeze your property or ban cryptocurrencies, there’s nothing you are able to do. - Locked Ethereum:

If you stake ETH, your ETH tokens are locked, and also you received’t have the ability to withdraw or use them till the Ethereum 2.0 (ETH 2.0) Merge is accomplished. Whereas the Ethereum Basis has hinted at September 2022 because the date for the Merge, there isn’t a assure that it’ll occur on time because it has repeatedly confronted delays because of complicated technical points.

Conclusion

Ethereum was a pioneer concerning good contracts, on which the entire Web3 is constructed, and the catalyst that helped the adoption of blockchain globally. With the transfer in direction of PoS blockchain, Ethereum 2.0 will turn out to be quicker, extra scalable, and sustainable. It’ll allow excessive transaction throughput and low fuel charges with out sacrificing decentralization or safety.

So, begin staking Ethereum at present and turn out to be a part of the oncoming revolution whereas additionally incomes a secure passive revenue.

Nonetheless, keep in mind that cryptocurrencies are extremely risky, and it is best to at all times do your individual analysis earlier than investing in them. Nothing on this article is a bit of monetary recommendation, and it is best to solely make investments what you’ll be able to afford to lose, as everlasting and full losses are widespread in crypto, as witnessed within the current $LUNA crash.

Should you’re all for studying extra about DeFi and the way to benefit from it, go to our full information, “What Is DeFi.” To be taught extra about preserving observe of all of your portfolios, try our information on “crypto portfolio trackers.”