Some individuals who critique my varied funds charts are irritated I listing retirement contributions and investments as bills. Subsequently, I believed I’d clarify my logic on this publish.

When you begin treating your retirement contributions and investments as bills, you’ll start to construct way more wealth than the typical individual. And when you construct extra wealth than the typical individual, your frustration will subside, and you’ll really feel extra free.

The hot button is to go from a defensive mindset to an offensive mindset to construct extra wealth. Let’s begin with a fundamental understanding of two monetary statements.

Earnings Assertion: Investments As An Expense

Under is a pattern funds of a family making $350,000 a 12 months.

The beneath funds will also be considered as an Earnings Assertion. The Earnings Assertion solely has Earnings and Bills. Subsequently, it’s essential to categorize any line merchandise that isn’t an Earnings as an Expense and vice versa.

Given cash have to be spent to contribute to a retirement plan, a 529 plan, a mortgage, and varied insurance coverage insurance policies, these line objects are bills. These bills cut back the underside line, which is the Money Circulation After Bills line in inexperienced.

To remain in step with the Earnings Assertion analogy, the Money Circulation After Bills line merchandise must be labeled as Web Revenue, as there may be additionally a Money Circulation Assertion in finance. Nonetheless, no person calls the cash they’ve left over as internet revenue.

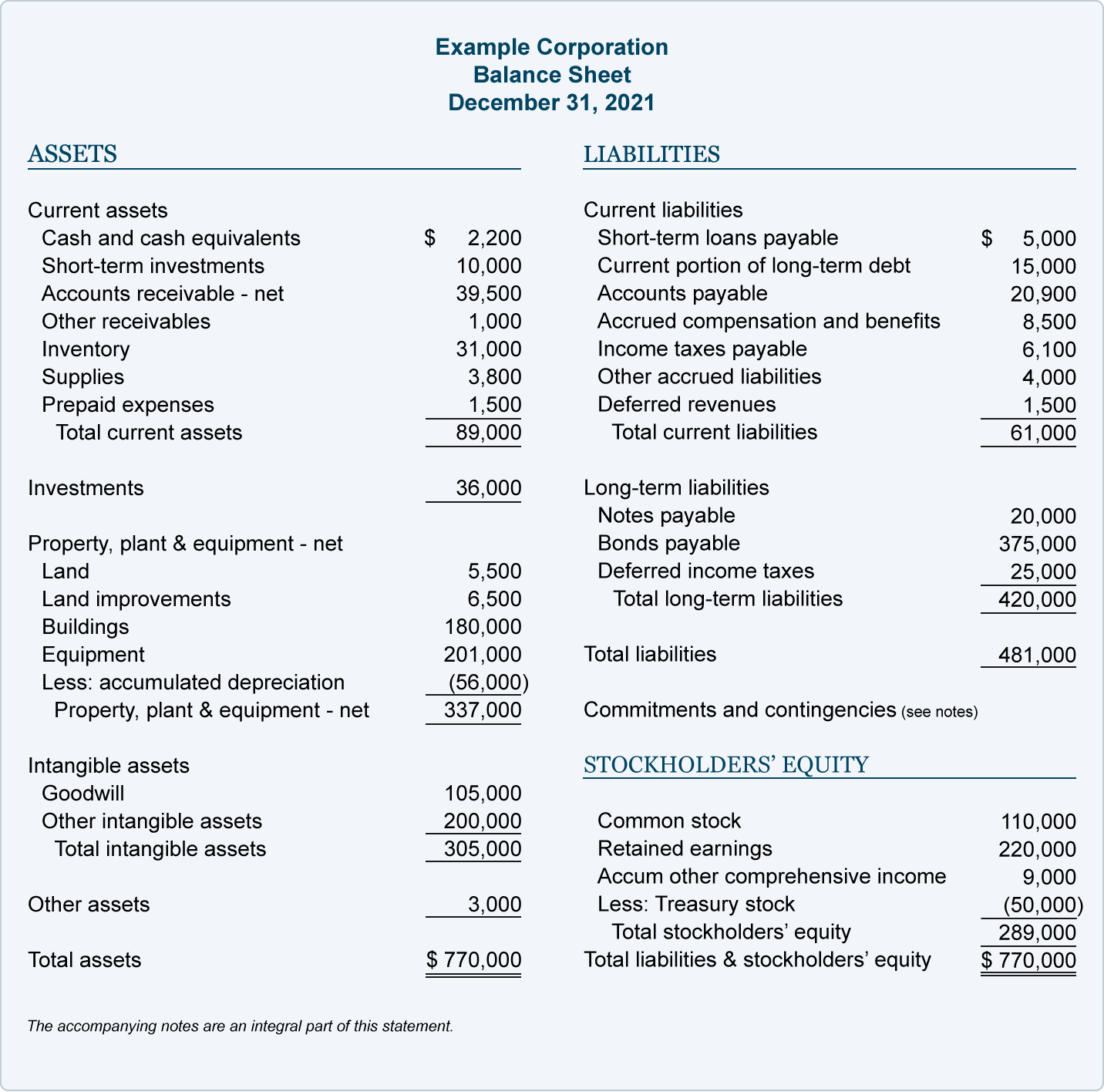

Steadiness Sheet: Investments Are Thought-about Property

Please don’t confuse an Earnings Assertion with a Steadiness Sheet. A Steadiness Sheet is the place you’ll be able to label all investments and retirement contributions as Property. Whereas an Earnings Assertion solely comprises earnings and bills.

A private steadiness sheet primarily calculates one’s Web Price. And Web Price is calculated by including up the worth of all Property and subtracting the worth of all Liabilities.

Over time, you hope your retirement funds and different investments like actual property develop in worth. In the event that they do, your belongings and your internet price go up in case your liabilities keep the identical or go down.

Even when your investments are declining in worth, they don’t seem to be thought-about liabilities. Examples of liabilities embrace mortgage debt, bank card debt, cash owed to suppliers, taxes owed, and wages owed.

Under is an instance of a Company Steadiness Sheet. You’ll be able to translate Stockholder’s Fairness into Web Price if the beneath was a Web Price Assertion.

Why Folks Get Bent Out Of Form About Investments As An Expense

Not having a elementary grasp of economic statements is why most individuals are upset I listing investments as an expense.

These of us assume I’m making an attempt to trick them into pondering a $350,000 family earnings household is poor with solely $19 a month or $224 a 12 months in money circulate left over. No, they don’t seem to be poor. You’re solely tricked by what you see if you happen to don’t perceive what you’re taking a look at.

On the identical time, critics appropriately level out such a household is contributing $41,000 a 12 months of their 401(okay), $26,400 a 12 months of their 529 plans, and constructing $25,200 a 12 months in dwelling fairness. The overall internet price contribution to such bills is roughly $92,700 a 12 months.

As somebody who needs to attain monetary independence, one in all your objectives is to reduce taxable earnings and maximize internet price. When you obtain a internet price equal to no less than 10X your gross earnings, you might be near monetary independence. As soon as your internet price equals 20X your gross earnings, you might be completely free to do no matter you need.

Issue Investing For The Future

Another excuse why some folks don’t like treating retirement contributions as an expense is that investing requires self-discipline and delayed gratification. Generally, all you wish to do is spend your cash on dwelling it up now. Many are logically performing some revenge spending given the pandemic is nicely into its third 12 months.

Subsequently, it might be laborious for some folks to conceptualize that with a purpose to reside a extra free life afterward, it’s essential to first spend by investing. Though there are not any ensures in investing, traditionally, investments in shares, actual property, and different asset courses do present optimistic returns.

Delayed gratification by way of investing is an expense. You sacrifice good instances now for hopefully good instances later. Those that failed the marshmallow take a look at after they had been younger are seemingly failing the act of saving and investing sufficient for his or her future.

Investments As A Luxurious Expense

Some folks battle greater than others to outlive. When you find yourself having a tricky time affording fuel and groceries, it might upset you that others can. In different phrases, investing is considered as a luxurious expense they can’t afford.

Nonetheless, deep down, all people is aware of we have to make investments for our future. In any other case, we are going to find yourself working long gone after we are totally succesful or wish to.

So sure, investing is taken into account a luxurious expense for individuals who are having a harder time making ends meet. Fortunately, investing in shares is now free resulting from zero commissions.

We are able to purchase ETFs and fractional shares with lower than $100. We are able to even put money into a non-public actual property fund with simply $10 to start out by way of Fundrise, my favourite actual property investing platform for all buyers.

Therefore, investing is probably not as large of a luxurious expense as some may assume. The extra we will get educated concerning the energy of investing, the much less we are going to view investing as a luxurious expense and extra as a necessity.

Insurance coverage As An Expense

Most individuals gained’t debate whether or not insurance coverage is an expense or not. You’re spending cash to pay for one thing to guard you sooner or later in case of a calamity.

I’ll fortunately pay $115/month for my new 20-year, $750,000 time period life insurance coverage coverage I bought because of PolicyGenius as a result of I’ve two younger youngsters and mortgage debt. Defending my household over the subsequent 20 years is paramount. As soon as my children are of their 20s, they need to have the ability to fend for themselves. My life insurance coverage premiums are positively an expense.

Subsequently, why would anyone argue that contributing $41,000 a 12 months to 2 401(okay) plans shouldn’t be thought-about an expense when the contributions are made to care for the instance family in retirement? Few folks can and wish to work perpetually. I fizzled out earlier than age 35 at a standard day job and faux retired. By the point I’m 50 I most likely gained’t wish to write as a lot both.

If insurance coverage is taken into account an expense to guard your future, then investments must also be thought-about an expense.

Mad About The Quantity Earned And Invested

The ultimate motive why I feel some folks don’t view retirement contributions and investments as bills is as a result of they’re upset by the quantities I’ve highlighted.

Due to inflation, my $300,000 earnings assertion from a number of years in the past has now jumped to $350,000 at the moment. Due to the federal government rising the utmost 401(okay) contribution to $20,500 from $19,500, the whole 401(okay) contribution for 2 is now $41,000 in my chart and never $39,000.

Nonetheless, if I revealed a $60,000 family earnings assertion and a $3,000 annual 401(okay) contribution quantity, perhaps that might be extra “acceptable.”

Please don’t get fixated on absolutely the greenback quantities. All of us reside in several components of the nation with completely different price of dwelling requirements and tastes. I’m utilizing these figures as a result of $300,000+ is what it takes to reside a middle-class way of life with two children in San Francisco. In the meantime, I’m all the time a proponent of maxing out your 401(okay).

It was powerful to max out my 401(okay) once I was solely making $40,000 and dwelling in Manhattan. However I did so as a result of I shared a studio with a good friend. I additionally labored late so I may eat on the free cafeteria every evening. On reflection, the sacrifices had been price it.

Maintain Your Funding Bills Excessive!

I used to be going to conclude by encouraging everybody to maintain their bills low with a purpose to quicken their tempo to monetary independence. However then I noticed this was a defensive strategy to save your strategy to wealth and freedom. As an alternative, I’m a a lot greater proponent of spending your strategy to wealth and freedom, which is the subtitle and core idea of my new guide.

Since we now all agree our investments ought to all be thought-about bills, let me encourage you to maintain your funding bills excessive! Go on the offensive to win extra wealth. This can be a important mindset shift I encourage everybody to undertake.

On the finish of the day, you need your investments to generate as a lot passive earnings as doable to be free. Relying on the place you might be, your investments may very well be your largest expense of all of them!

Readers, do you see retirement contributions and investments as bills? If not, why? Why can’t some folks view investing for his or her future as a gift day expense?

For extra nuanced private finance content material, be part of 50,000+ others and join the free Monetary Samurai e-newsletter. Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009. To get my posts in your inbox as quickly as they’re revealed, join right here.