Key Takeaways

- The burning deadline for Damien Hirst’s The Forex NFT assortment closed immediately.

- Simply over half of the NFTs had been burned, making the digital items barely extra scarce than their bodily equivalents.

- Regardless of the excitement surrounding Hirst’s assortment, the NFT house continues to undergo because of the extended crypto market droop.

Share this text

5,142 NFTs had been exchanged for bodily work, making the remaining digital items extra scarce than their bodily counterparts.

Damien Hirst’s Artwork Burning Deadline Closes

Damien Hirst followers appear to be divided on whether or not bodily artwork is extra precious than digital artwork.

The burning deadline for the legendary artist’s first NFT assortment closed immediately with simply over half of the holders opting to redeem their digital collectible for a corresponding bodily piece of artwork. 5,142 NFTs from the gathering had been exchanged for bodily works, leaving 4,858 NFTs.

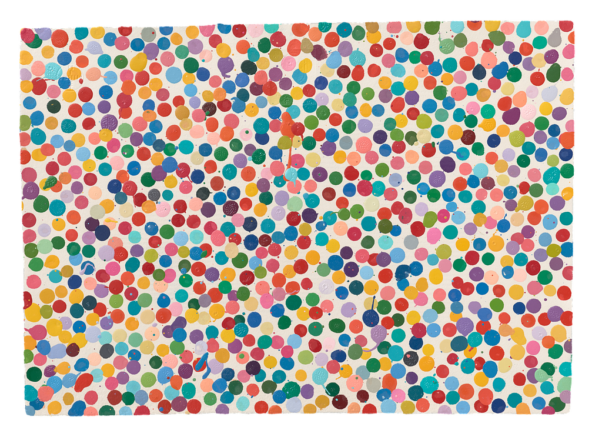

The ten,000-piece assortment, dubbed The Forex, launched in July 2021 amid a growth within the NFT market. Created in 2016 and later minted on the Palm blockchain, the gathering references the long-lasting polkadot type that Hirst pioneered. Hirst opted to make his first foray into the digital artwork house with a singular twist: anybody who purchased one of many NFTs might select to burn their token in alternate for an equal bodily piece. Conversely, the bodily work could be destroyed if the collector held onto their NFT.

“The Forex explores the boundaries of artwork and foreign money—when artwork modifications and turns into a foreign money, and when foreign money turns into artwork,” the promotional copy for The Forex stated. The gathering went on sale with an entry value of $2,000; immediately the NFTs are definitely worth the equal of round $7,500 on the secondary market (Hirst additionally rewarded collectors with a Thanksgiving airdrop based mostly on his paintings for Drake’s Licensed Lover Boy cowl in November).

Though the gathering experimented with figuring out the worth of bodily artwork in opposition to digital artwork, the end result of the burning occasion signifies that Hirst collectors within the still-niche NFT market are largely undecided.

NFT Market Takes a Hit

Whereas Hirst’s The Forex was the speak of the NFT house immediately, the broader market has suffered for months as crypto endures an prolonged winter interval. Buying and selling volumes on marketplaces like OpenSea have plummeted to 12-month lows as confidence within the house wanes and macroeconomic fears persist, whereas the ground costs for a lot of top-tier collections have slid from their all-time highs alongside fungible crypto property like Bitcoin and Ethereum. Bored Ape Yacht Membership, the breakout star of the 2021 NFT bull run, topped a ground value of $436,000 in Could; immediately the most cost effective go for nearer to $127,000 (The ground value for an ape has dropped from 156 ETH to 86 ETH, however ETH has additionally declined in greenback phrases).

Damien Hirst is among the world’s most famed artists. He’s arguably finest recognized for his varied Nineties works that preserved useless animals, together with “The Bodily Impossibility of Loss of life within the Thoughts of Somebody Dwelling,” which featured a 4-meter-long tiger shark in a formaldehyde-filled tank. He’s embraced NFTs for the reason that market exploded in 2021, following up The Forex and its related airdrop with a brand new assortment referred to as The Empresses earlier this yr.

Disclosure: On the time of writing, the creator of this piece owned some Otherside NFTs, ETH, and several other different fungible and non-fungible cryptocurrencies.