On-chain information reveals the Bitcoin derivatives change reserve has surged up just lately, an indication that the crypto might face extra volatility within the close to future.

Bitcoin Derivatives Change Reserve Observes Uplift Over Final Two Days

As identified by an analyst in a CryptoQuant submit, circumstances appear to be brewing up within the BTC market that might result in larger volatility within the worth.

The “derivatives change reserve” is an indicator that measures the full quantity of Bitcoin at the moment sitting within the wallets of all derivatives exchanges.

When the worth of this metric goes up, it means buyers are depositing their cash into these exchanges proper now. Since BTC going up on derivatives typically results in a rise in leverage, such a pattern can lead to larger volatility within the worth of the crypto.

Alternatively, the worth of the indicator registering a decline implies cash are exiting derivatives exchanges as holders are withdrawing them. This sort of pattern might precede a extra calmer BTC worth.

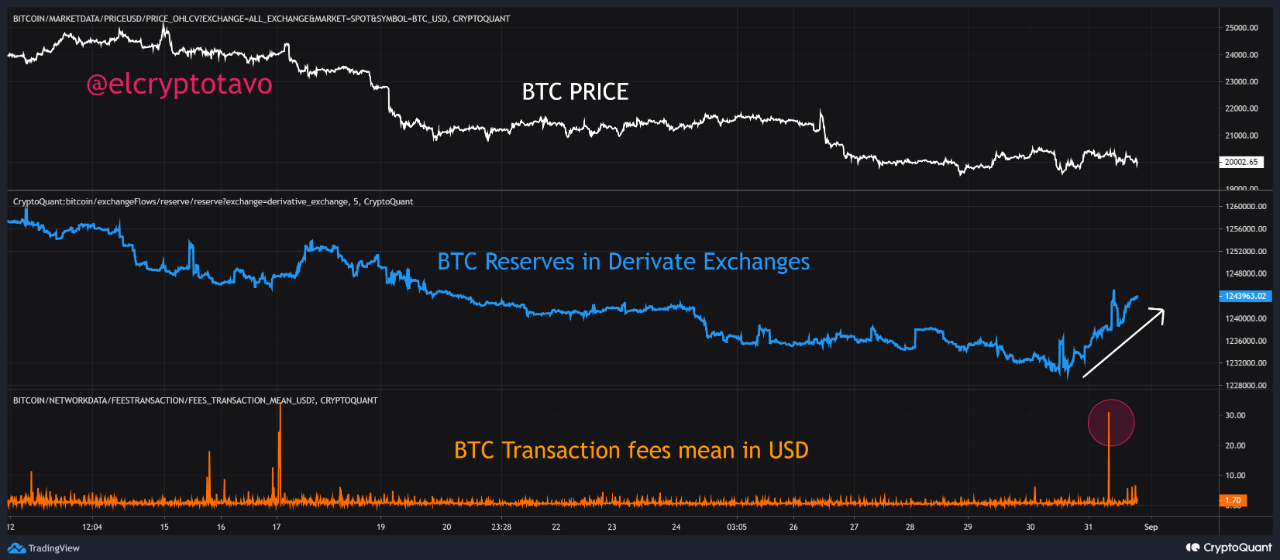

Now, here’s a chart that reveals the pattern within the Bitcoin derivatives change reserve over the previous few weeks:

The worth of the metric appears to have climbed up in latest days | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin derivatives change reserve has seen some upwards momentum over the past couple of days. This reveals that leverage available in the market is now going up.

The chart additionally contains information for the imply worth of the BTC transaction charges (in USD), and it seems like this metric additionally noticed a spike throughout the previous day, suggesting there have been some massive strikes available in the market.

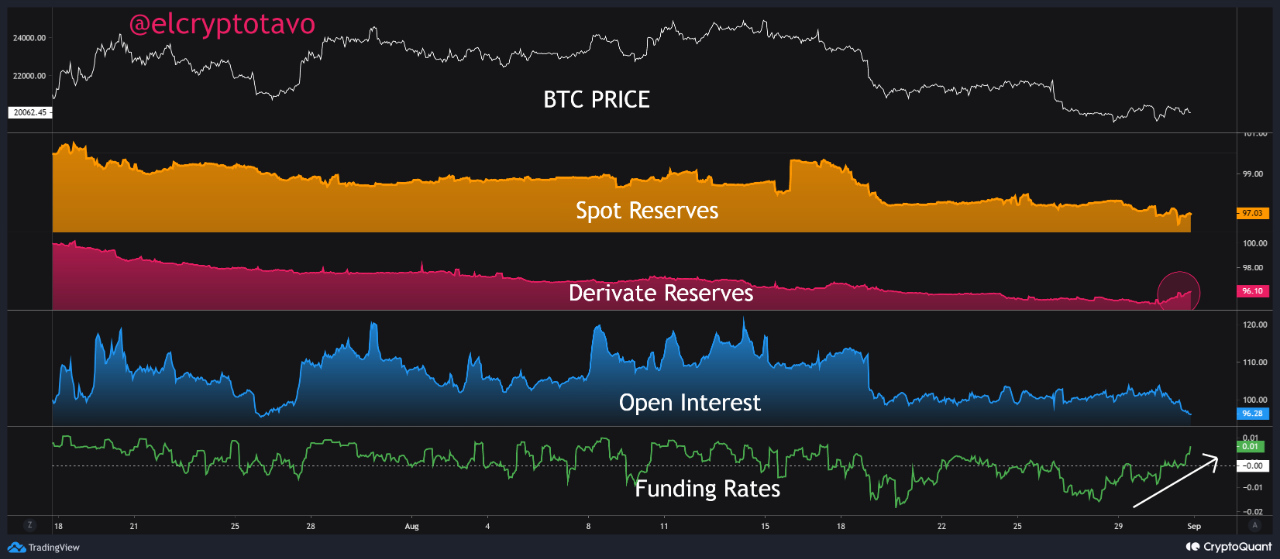

Beneath is one other graph, this time together with the pattern for the BTC funding charges:

The funding charges have gone up over the previous day | Supply: CryptoQuant

As is obvious from the chart, the funding charges have jumped into constructive values with this improve within the derivatives reserve.

Which means that the buyers sending cash to those exchanges have opened up lengthy contracts, thus shifting the market steadiness right into a long-dominant surroundings.

Up to now, the mixture of constructive funding charges together with excessive derivatives reserve has often meant excessive close to time period volatility for Bitcoin, with the worth typically falling down.

BTC Worth

On the time of writing, Bitcoin’s worth floats round $20k, down 8% previously week.

Appears like the worth of the crypto has been transferring sideways throughout the previous few days | Supply: BTCUSD on TradingView

Featured picture from Yiğit Ali Atasoy on Unsplash.com, charts from TradingView.com, CryptoQuant.com