By Arcane Analysis analyst’s estimate, Tesla solely suffered a slight loss within the Bitcoin dump as 75% of its holdings have been offered at $32,209.

In a current Twitter thread, Arcane Analysis analyst Vetle Lunde revealed what number of Bitcoin institutional buyers had offered since Terra’s carnage kicked in, thus tanking the entire crypto market. In his estimate, Tesla offered 29,060 BTC at a median worth of $32,209 in Might.

Pressured Promoting

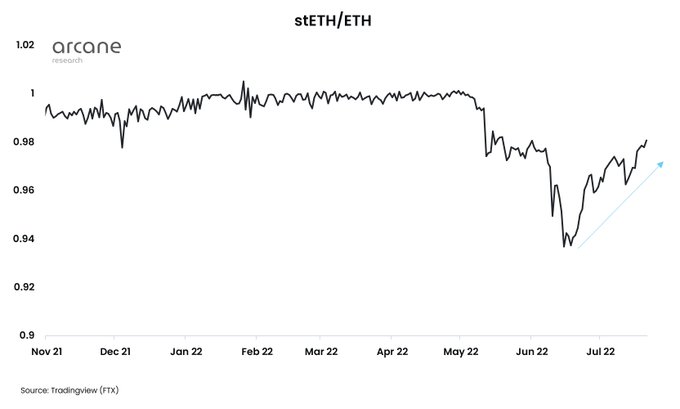

In Lunde’s view, large institutional blow-ups prior to now two months began from Terra’s collapse on Might tenth – when Do Kown offered over 80K BTC to defend the UST peg.

Since then, the contagion has unfold rapidly throughout the trade and deepened the promoting stress, resulting in 236,237 BTC being offered by giant establishments. Lunde famous that “the quantity doesn’t account for different pure capitulation and hedging exercise that normally happens throughout crypto bear markets.”

Amidst markets going bitter, publicly traded miners have been pressured to dump their Bitcoin holdings, promoting a complete of 4,456 BTC within the month. Within the meantime, Tesla offered 75% of its BTC holdings, which might be translated to 29,060 BTC, based on Lunde’s estimate. Tesla nonetheless holds 9,686 BTC – down from 43,053 by Feb.1st, 2021.

Contemplating that Tesla offered 10% of its former holdings for “testing liquidity” in Q1 2021 when Bitocin rallied, the EV big’s new break-even worth of BTC got here down from $34,841 to roughly $33,325. Subsequently, when executing the large gross sales in Might this 12 months, Tesla solely suffered a slight loss.

Bankruptcies Hitting Lending Companies

In June, the predominant promoting stress first stemmed from the CPI index hike, which despatched the asset’s worth south once more, “bankrupting a number of whales already underneath stress after Luna’s collapse.” Particularly,

3AC’s meltdown impacted already-troubled lenders like Celsius and Voyager, which each filed bankruptcies within the following month. The Singapore-based hedge fund owed lenders 18,193 BTC and different digital property equal to 22,054 BTC, based on leaked courtroom paperwork.

Along with 3AC’s large liquidation that dragged down the entire market, Canadian Function ETF redeemed 24,510 BTC between June sixteenth to June twentieth, additional exacerbating the market selloffs. Because of this, the first cryptocurrency even dipped beneath $17,700 at one level on June nineteenth.

The final two months had been a capitulation part, concluded Lunde. The extent of the market selloff may have been worse than what he had coated resulting from “underwater retail and establishments capitulating.” For now, He believed the continued reduction rally has indicated that the contagion is getting resolved as market uncertainty declines.